Dick Van Dyke sparked concern after dropping out of an event last-minute due to illness.

The 99-year-old entertainer was scheduled to co-host his musical charity event, Vandy Camp, with his wife Arlene Silver on Saturday. Unfortunately, he had to call off his participation at the last minute.

Arlene Silver, aged 53, broke the news to the audience at the Arlene & Dick Van Dyke Theater located at Malibu High School. She shared that the legendary actor, a Tony award winner, was not feeling well that day.

During her speech, she began by telling the audience that she is ‘not the Van Dyke you’re expecting,’ per People.

‘I have to inform you that Dick is not up to coming to celebrate with us today,’ she said. ‘I’m sorry.’

This comes just weeks after the silver screen icon revealed what the ‘curse’ of living to almost 100 is.

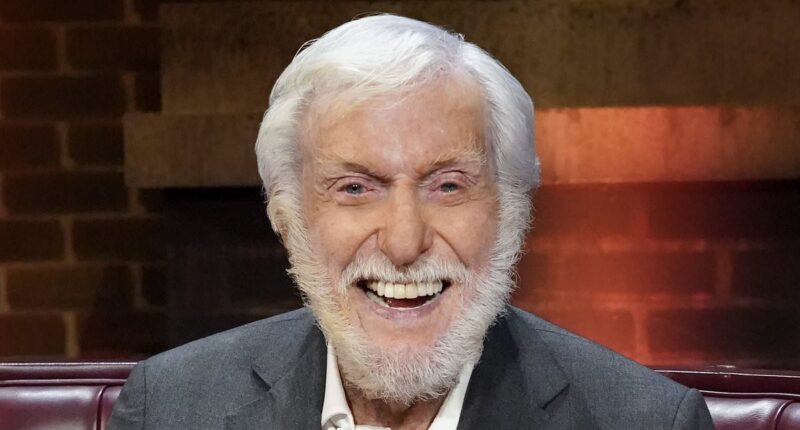

Dick Van Dyke sparked concern after dropping out of an event last-minute due to illness; pictured December 2024

The makeup artist continued: ‘When you’re 99-and-a-half years old, you have good days and bad days.

‘And unfortunately, today is not a good day for him, and he’s sick that he can’t be here,’ she added.

However, Van Dyke did still make an appearance on a livestream on the same day.

Silver said that she was ‘pretty confident’ that Van Dyke would be at the next Vandy Camp event ‘in person.’

In her address, she emphasized her husband’s deep commitment to Vandy Camp, highlighting that the event is more than just about the famous Dick Van Dyke.

She explained: ‘It is a celebration of your childhood, all of our childhoods, the music that’s in the fabric of all of us, [and] Dick Van Dyke is a big part of that.’

She also gushed about his fans, adding that his supporters ‘are the greatest human beings I’ve ever known.’

‘These Vandy Camp [events] are a wonderful opportunity to have you all in the same room and meet each other.’

The 99-year-old actor was supposed to host his musical fundraising event, Vandy Camp, on Saturday alongside his wife Arlene Silver but had to cancel his appearance last minute; pictured April in Malibu

His wife, 53, announced the news to those in attendance at the Arlene & Dick Van Dyke Theater at Malibu High School and explained that the Tony-winning star was not having a ‘good day’; pictured June 2024 in Los Angeles

During her speech, she began by telling the audience that she is ‘not the Van Dyke you’re expecting’; pictured June 2024 in Los Angeles

Silver then gushed about her husband of 13 years, with whom she shares a 46-year age gap.

She said that ‘being around him just as a human being has made me a better person.’

She also praised the star and their musical group, an a cappella quartet the Vantastix, for giving her ‘so much confidence to be able to stand up here right now.’

She suggested that she felt out of her ‘comfort zone’ without him since she said Van Dyke was her ‘safety net.’

‘I would never be able to do this maybe, like, a year ago, but I’ve had so many experiences pushing myself out of my comfort zone, and right now I’m out of my comfort zone.’

She added: ‘But I have to wear my big girl pants and hold the reins without Dick here as the safety net that he’s always here with me.’

The Mary Poppins star and the makeup artist met at the SAG Awards in 2006 and later tied the knot six years later.

Last month, the movie star opened up about the reality of living to be a nonagenarian.

Silver then gushed about her husband of 13 years, with whom she shares a 46-year age gap. She suggested that she felt out of her ‘comfort zone’ without him since she said Van Dyke was her ‘safety net’; pictured June 2024 in Hollywood

Last month, the movie star opened up about the reality of living to be a nonagenarian. The curse of living until nearly 100 is ‘outliving everybody,’ he said in an interview with his wife; pictured June 2024 in Los Angeles

When asked by his significant other what the secret to remaining positive is despite his losses, Van Dyke, who turns 100 in December, answered, ‘Well, life’s been good to me. I can’t complain’; pictured September 2024 in Los Angeles

He reflected on his long life during a Q&A at one of their Dick & Arlene Van Dyke Present Vandy Camp event several weeks ago.

During the conversation, Dick revealed he and his late friend Ed Asner had planned to do a remake of The Odd Couple before his death at age 91 in August 2021.

‘That would’ve been such fun, and we lost it. I’ve lost a lot of friends,’ the actor noted, according to an account from People.

His wife added: ‘He’s outlived everybody. That’s the curse of living to almost 100.’

When asked by his significant other what the secret to remaining positive is despite his losses, he answered, ‘Well, life’s been good to me. I can’t complain.’

Van Dyke, who turns 100 in December, said he continues to perform at his age because it energizes him. ‘I’m a ham. I love it. I get a jolt of energy from an audience.’