This article is an onsite version of our Trade Secrets newsletter. Premium subscribers can sign up here to get the newsletter delivered every Monday. Standard subscribers can upgrade to Premium here, or explore all FT newsletters

Hello. It’s me back again after Aime Williams superbly stood in last week. Her take on the World Bank in the run-up to its spring meetings is here if you missed it. This week’s newsletter is on some signs of what might happen after two elections coming up this year: in the US, a plan for a more coherent plan on trade and climate; in the UK, trade realignment with the EU. Charted waters is on the disturbingly weak yen.

Get in touch. Email me at alan.beattie@ft.com

Green talk from the White House

There was a speech last week that maybe didn’t get the attention it deserved. John Podesta, veteran of the Bill Clinton and Barack Obama administrations, who took over from John Kerry as President Joe Biden’s chief climate diplomat in January, laid out the administration’s plans for decarbonising trade. There was nothing massively new in the substance, but the tone and the framing, including launching a White House Climate and Trade Task Force (initial caps throughout to show they mean business) were notable.

Hitherto, pushing the Biden administration’s green policies through Congress has been shaped by the need to get everything past Joe Manchin of West Virginia, the fossil fuel-loving swing voter in the Senate. But Manchin (and self-publicising habitual obstructionist Kyrsten Sinema) are retiring after November’s elections. With some grown-up conversations taking place on Capitol Hill and even a reasonable chance of the Democrats retaining the Senate and taking the House, suddenly there might be an environmentally minded Congress with which the administration can do more constructive business.

Elevating the articulation of the issue from the unfortunately largely ineffectual leadership at the US trade representative’s office to a White House heavy-hitter is certainly helpful.

So is the commitment to work with trading partners to create standard methodologies for measuring carbon emissions. This is not before time. Rupert Schlegelmilch, until recently the European Commission’s director for US trade issues, rather drily tweeted after Podesta’s speech that “this is indeed progress”, in the sense that the EU had repeatedly asked the US for these kind of discussions in vain.

You can see Schlegelmilch’s point. It was last summer when the administration asked the independent US International Trade Commission agency to investigate how to measure greenhouse gas emissions from manufacturing steel and aluminium (aluminum, whatever). Ten months later and the ITC is still running seminars for companies on how to fill in the forms. (There’s one tomorrow on Webex if you’re interested.)

In any case, the general tone of international collaboration sounds good, especially compared with the US’s clumsy failed attempts so far to bully and bounce the EU into backing its green steel and aluminium club.

But here’s the big problem. The rhetoric on aligning emissions standards and carbon taxes sounds all very multilateralist. But the various proposals for said taxes that have been floating around Capitol Hill, certainly on the Republican side, are generally heavy on border charges but light or absent on domestic pricing.

That’s just not going to get the EU on board. Essentially it’s just the old green steel club in a new wrapping. Any arrangement without a domestic tax doesn’t do much to promote decarbonisation at home, is very likely WTO-illegal and to much of the rest of the world will look like yet another way the US has found to protect its steel industry. It’s hard to see the US getting many other countries to sign up to this. Meanwhile, the EU’s CBAM is not exactly universally popular but is stimulating conversations and starting alignment about carbon pricing worldwide.

It’s good the administration is communicating on this; it’s good that Podesta is in charge; it’s good that it’s thinking about the next Congress. But sooner or later there will be a reckoning. A climate and trade policy that imposes a carbon border tax without a domestic counterpart isn’t the solution the planet needs.

The EU’s gravitational pull for UK goods trade

So last week we learned just how toxic the mention of freedom of movement (FOM) with the EU is to UK’s Labour opposition. The party rather absurdly rejected out of hand a suggestion by the commission to agree the kind of EU-wide youth mobility deal that Rishi Sunak’s government was keen to do with a bunch of EU member states.

Obviously, there won’t be any sanity on that subject from Labour until after an election: let’s hope it’s the election in 2024 and not in 2029. But in the meantime there are some interesting dynamics on the goods rather than the services/FOM side. Labour have also ruled out a customs union agreement with the EU, but in some ways economic gravity is going to pull the UK closer to EU rules on goods unless they’re insanely self-destructive.

Our old friend CBAM is one. (I might just rename this newsletter CBAM Secrets and have done with it.) Sunak’s government may bleat on about designing a CBAM for the UK’s specific needs, but divergence with the EU version won’t survive threats such as high-emissions steel from India that’s been excluded from the EU market washing up in the UK and destroying steel production in Port Talbot. As my FT colleagues have described, there’s also a serious problem with carbon border taxes on electricity generation. Realistically, the only choice Labour will have to make is whether they actually rejoin the EU’s emissions trading scheme (ETS) and CBAM like Norway or concoct a shadow version like Switzerland, which still leaves British companies with a tonne of paperwork to submit.

Similarly, the UK is likely to have to match the EU’s antisubsidy duties on Chinese electric vehicles unless it wants to be inundated with cars that can’t get into the EU market. Generous rules of origin on EVs in the EU-UK trade agreement may have been extended until the end of 2026, but as that deadline approaches the costs of divergence from the EU’s customs regime will also start to loom. And if British companies want to export to the EU anything that uses the commodities covered by the EU’s deforestation regulation, the UK will probably just copy-paste that regulation itself rather than its current light-touch version.

Labour won’t say so now, obviously, but in a bunch of areas the costs of divergence on trade in goods is becoming clear and will push the UK towards more alignment with the EU. A customs union is a more immediate and politically palatable vehicle than the single market and FOM for the UK to tack back towards rules set in Brussels.

Charted waters

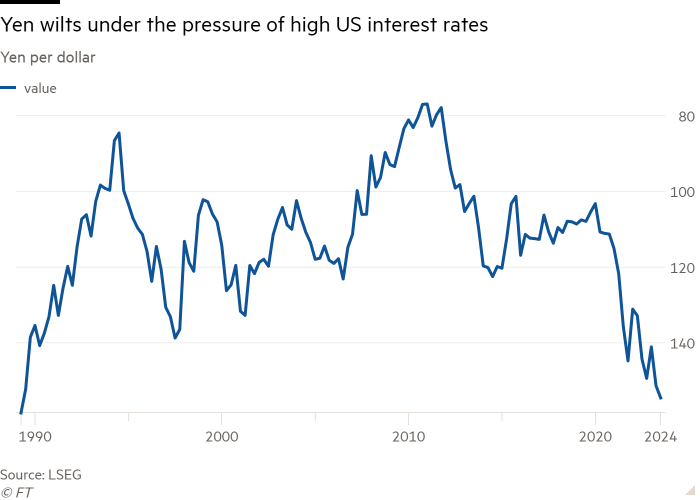

Interest rate differentials have put upwards pressure on the dollar that is widely regarded inside and outside the US as a bad thing. The US, Japan and South Korea issued an unusual joint statement last week as Tokyo and Seoul signalled they were concerned about the weakness of the yen and the won.

Trade links

European companies are facing fierce competition from Chinese businesses in the Chinese market . . .

. . . while the Chinese car manufacturer Chery is launching production in Europe, using a former Nissan factory in Spain . . .

. . . and China is hitting back at suggestions it is dumping goods on the world market from building excess capacity.

A really intriguing story as the US UAW labour union files charges against Mercedes-Benz for opposing a unionisation drive at its plant in Alabama. The case relies on Germany’s newish supply chain law, which aims to protect labour standards in German companies’ operations and suppliers overseas.

US and European pharmaceutical manufacturers are concerned about supply shortages because a Chinese anti-espionage law is deterring them from sending inspectors to certify Chinese production facilities.

The development guru Charles Kenny writes for the Cato Institute on how globalisation can help combat climate change.

Trade Secrets is edited by Jonathan Moules

Also Read More: World News | Entertainment News | Celebrity News