A significant development from Xi Jinping’s China is the imposition of an imposing 84% tariff on American products starting Thursday, marking a substantial increase from the previously disclosed amount and signaling a heightened phase in the ongoing global trade conflict.

Following US President Donald Trump’s declaration of extensive reciprocal tariffs on what he labeled as ‘Liberation Day,’ financial markets worldwide have experienced a downturn due to escalating trade tensions fueled by accusations of the US being taken advantage of by other countries.

The United States encountered a universal 10% tariff on imports from almost every corner of the globe, a measure that the Trump administration augmented pro-rata based on existing trade imbalances.

But China was hit particularly hard, with Trump slapping imports from Xi Jinping’s nation with an effective 104% levy.

Trump’s tariffs have caused global markets to drastically crash. So far today, the FTSE 100, an index fund detailing the value of Britain’s 100 largest firms, dropped 3.6% at time of publication.

Germany’s DAX was down 4%, while the French CAC 40 was down 4%. US index funds are also expected to fall when they open at 2.30pm UK time.

China said its revenge tariffs would take effect from around noon local time (5am UK time) April 10, giving global supply chains less than a day to reorient themselves and piling more pressure on the world’s economy.

It added that it was putting export controls on 12 more American companies, and had added six more US firms to its list of ‘unreliable entities’ that are largely banned from doing business in China or with Chinese companies.

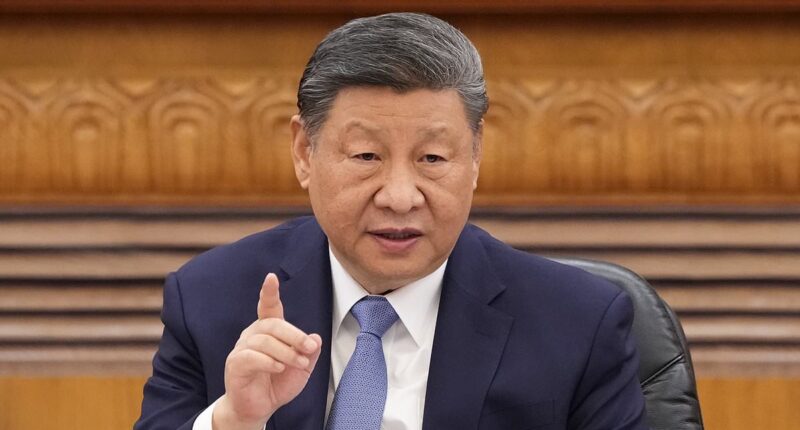

Xi Jinping’s (pictured) China will impose 84% tariffs on U.S. goods from Thursday, up from the 34% previously announced

Donald Trump slapped imports into the US from other nations with a wide array of tariffs

These companies have not yet been announced.

China today told the World Trade Organisation that the US’ decision to impose these mass tariffs threatens to further destabilise global trade.

‘The situation has dangerously escalated. …As one of the affected members, China expresses grave concern and firm opposition to this reckless move,’ China said in a statement to the WTO on Wednesday that was sent to Reuters by the Chinese mission to the WTO.

The financial world has been rattled by Trump’s tariffs, and have begun to seriously question his decisions.

Dario Perkins, an economist at macroeconomic forecasting consultancy firm TS Lombard, told Bloomberg earlier this week: ‘For the first time in my career, I’m hearing widespread skepticism about the competency of US policymakers.

‘This isn’t about politics… And it isn’t about ‘policy mistakes’… It is about recklessness.

‘That is why many global investors are also making the comparison with the UK’s “Liz Truss moment”.’

Earlier today, the Bank of England said Trump’s tariffs have ‘contributed to a material increase in the risk to global growth’ and financial stability.

In the central bank’s Financial Stability Report, published hours before China announced the retaliatory tariff measures, it said that the economic hostility between the US and other nations has increased ‘uncertainty… for inflation globally.’

But it stressed that ‘UK household and corporate borrowers have remained resilient’, adding that it ‘maintained its judgement’ that British banks would still be able to support households and businesses even if the economy turned ‘substantially worse than expected.’

Despite the flood of anxiety from the financial world, US Treasury Secretary Scott Bessent said he believed America’s tariffs would lead to nations signing deals favourable to the US.

He said, citing ongoing trade discussions with Japan, Vietnam, South Korea, India and Britain: ‘I think we are going to see a rapid succession of these deals that will give CEOs greater certainty.’

Bessent also warned China not to ‘devalue their way out’ of the trade war, and urged its leaders to come to the table for a formal discussion.

More to follow.