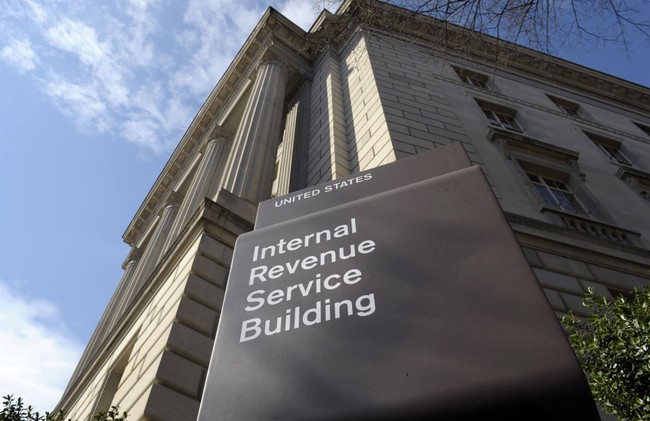

In a recent ruling by D.C. District Court Judge Dabney Friedrich, the Trump administration secured a legal victory when the judge denied the plaintiffs’ request for a preliminary injunction. This case involved a challenge to the sharing of data between the Internal Revenue Service (IRS) and the Department of Homeland Security (DHS) for immigration enforcement purposes.

Judge Friedrich asserted that the Memorandum of Understanding between the IRS and DHS did not violate the Internal Revenue Code, addressing the case’s central question about the legality of this data-sharing agreement.

(Note: Friedrich, a Trump appointee, is a woman, so that would be her order.)

The judge’s order, which spans 16 pages, was concise and to the point. Judge Friedrich pointed out a specific provision in the tax code that allows for the sharing of information as outlined in the agreement between the IRS and DHS, emphasizing the statutory basis for such exchanges.

On April 7, 2025, the IRS and DHS entered into a Memorandum of Understanding setting forth the process for exchanging information pursuant to the statute. In essence, the memorandum tracks the language of the statute and allows for the information to be exchanged for “persons subject to criminal investigation.” The plaintiffs, four nonprofit organizations representing the interests of immigrants, assert that this is somehow in violation of the law. Judge Friedrich disagreed and, as such, concluded that they were not likely to win the case on the merits, so a preliminary injunction was not warranted here.

RELATED: That Didn’t Take Long: D.C. Circuit Places Stay on Key Ruling That Favored Trump Administration

While it is unclear how many illegal aliens this may pertain to — the plaintiffs pointed to newspaper articles asserting that DHS had requested records for at least 700,000 illegal immigrants — the order provides an example of instances in which DHS might request taxpayer information from the IRS, including address information, in the context of a criminal investigation:

Also on Monday, Friedrich denied the motion of American Oversight (a group involved in several suits against the Trump administration) to intervene in the case. In doing so, she noted that she was unsealing most of the Memorandum of Understanding (MOU) between the IRS and DHS, along with the parties’ briefs, thus obviating American Oversight’s contention that intervention was warranted to access the documents at issue:

The MOU is a central focus of this litigation, and the information contained in the redacted MOU has been widely discussed, including on the record in open court at the April 16, 2025 preliminary injunction motion hearing. Although the government objects to its full disclosure, it has not asserted a compelling interest or high risk of prejudice with disclosure of the MOU and briefs. The public need for access is high given that the MOU’s content is essential to the claims raised by the plaintiffs and the Court’s reasoning in its forthcoming opinion on the 28 Motion for a Preliminary Injunction. The Court will not order, however, that the IRS “points of contact” on page 13 of the MOU be unsealed. With respect to those lower level government employees, the Court concludes that their personal privacy interests outweigh any public need to access their names and contact information.

In sum, this is a win for the administration, and one the plaintiffs may opt not to appeal, though we’ll continue to monitor it in case they do.