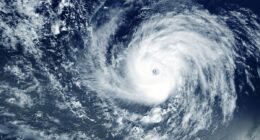

In Tallahassee, Florida, – Following the impact of Hurricane Helene and Hurricane Milton on Florida’s Gulf Coast last year, the Federal Emergency Management Agency is seeking a loan of $2 billion to cover claims from the National Flood Insurance Program.

FEMA, the governing body of the flood insurance program, disclosed that the two hurricanes had resulted in over 78,000 claims by February 6, with potential losses reaching upwards of $10 billion. FEMA has the ability to secure funds from the U.S. Treasury specifically for claim settlements.

In a recent press statement, FEMA stated, “This borrowing initiative is a direct consequence of disbursements made in 2024 due to various extensive flooding incidents occurring in quick succession. While the premiums from the NFIP (National Flood Insurance Program) typically cover claim expenses during non-catastrophic years, the intense rainfall episodes in 2024, encompassing hurricanes Helene and Milton, resulted in significant, widespread devastation leading to tens of thousands of flood insurance claims.”

Helene caused flooding and other damage in communities along the Gulf Coast before making landfall Sept. 26 in Taylor County as a Category 4 storm. It moved through parts of North Florida before causing heavy damage in other states, including North Carolina and Georgia.

FEMA did not provide a breakdown by state, but it said Helene had led to more than 57,400 flood insurance claims as of last week, totaling about $4.5 billion. The agency said the National Flood Insurance Program ultimately could face an estimated $6.4 billion to $7.4 billion in losses.

Milton made landfall Oct. 9 in Sarasota County as a Category 3 storm before crossing Florida. FEMA said Milton had led to more than 21,100 claims, totaling about $740 million, as of last week. It said estimated losses range from $1.2 billion to $2.9 billion.

“The NFIP is not designed to pay for multiple catastrophic events in a single year without additional financial assistance,” the agency news release said. “The combined losses from 2024 have depleted the NFIP’s funds generated from premiums to pay claims.”

Property insurance policies typically do not cover flood damage, forcing residents to buy separate coverage. Homeowners in certain parts of Florida are required to carry flood coverage if they have mortgages.

While some private companies offer flood insurance, the national program dominates the market, with nearly 1.8 million policies in Florida as of last month, according to agency statistics. Overall the program has about 4.7 million policies.

FEMA has $30.425 billion in borrowing authority to pay claims and had borrowed $20.525 billion after Hurricane Katrina in 2005, Hurricane Sandy in 2012 and Hurricane Harvey in 2017, the agency news release said.

“The widespread, devastating flooding following hurricanes Helene and Milton reemphasizes the financial effects flooding can have not just to survivors but also the National Flood Insurance Program,” Elizabeth Asche, senior executive of the program, said in a prepared statement. “We are strategically utilizing short-term borrowings in 60-day increments, demonstrating our careful and responsible management of the borrowing authority.”