These dramatic tax hikes can be overwhelming, but there are ways homeowners can reduce their burden.

In Ohio, state law requires counties to reappraise property values every six years. Last summer, Cuyahoga County underwent its scheduled reappraisal, and homeowners are now seeing the results of the updated valuations.

On average, property values in the county increased by 32%, and for many, this has translated into a sharp rise in property taxes. These dramatic tax hikes can be overwhelming, but there are ways homeowners can reduce their burden.

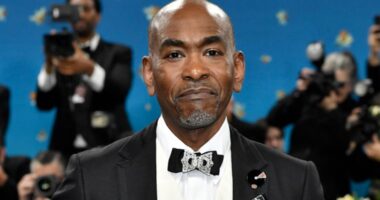

Cuyahoga County Treasurer Brad Cromes said there are multiple ways people can get help if they cannot afford to pay their taxes, and he said most people are eligible for one of them: The Owner Occupancy Credit.

The Owner Occupancy Credit offers eligible homeowners a 2.5% reduction on property taxes for their primary residence.

To qualify for the Owner Occupancy Credit, you must own and occupy the home as your principal place of residence as of Jan. 1 of the tax year for which you are applying.

For example, if you purchased your home in 2023, then you would be eligible for the credit in 2024.

You can apply for the credit by downloading the application from the Cuyahoga County Fiscal Officer’s website and submitting it to the County Auditor.

In addition to the Owner Occupancy Credit, the Cuyahoga County Treasurer’s Office has launched a Taxpayer Assistance Program aimed at helping seniors, which is designed for residents aged 70 and older and provides financial assistance for property taxes.

Eligible individuals can receive up to $10,000 in one-time financial aid to cover certified delinquent, late or even current property taxes.

There are multiple criteria one must meet in order to be eligible, including the following:

- The property must be the primary residence of the applicant, and they must have lived there for at least three years.

- There must be a certified tax delinquency on the property.

- The applicant’s household income must be less than $70,000 per year.

Cromes emphasized that this program is particularly helpful for those at risk of losing their homes, providing not just financial assistance but also housing counseling services to help residents address the root cause of their financial difficulties.

This support aims to put homeowners on a more sustainable path moving forward.

If you are eligible for the Taxpayer Assistance Program, applications are available through the Cuyahoga County Treasurer’s Office or on their website. Applications are processed on a first-come, first-served basis.

If those programs don’t work for you, it doesn’t mean you are out of options. If you feel your property valuation is too high, there is still time to challenge it.

According to Cromes, property owners have the opportunity to make a formal written complaint to the Board of Revision. The deadline to do so is March 31, and instructions for filing a complaint are included in an insert with your tax bill.