BANGKOK – The Asian stock market experienced a decline on Wednesday due to the implementation of a new set of U.S. tariffs, which included a significant 104% tax on Chinese imports.

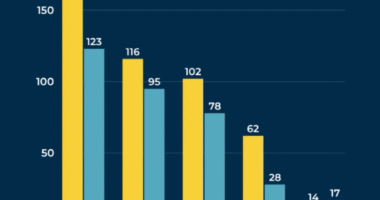

Japan’s Nikkei 225 index initially lost nearly 4% and markets in South Korea, New Zealand and Australia also declined.

The previous day saw the S&P 500 falling by 1.6% after erasing an early increase of 4.1%, bringing it close to 19% below its peak level from February. The Dow Jones Industrial Average also experienced a decrease of 0.8%, while the Nasdaq composite dropped by 2.1%. There remains a high level of uncertainty surrounding the actions that President Donald Trump may take in the ongoing trade conflict.

The significantly elevated tariffs were set to come into effect after midnight Eastern time in the United States, leaving investors unsure about the implications of President Trump’s trade policies.

The retreat overnight and into early Wednesday in Asia followed rallies for stocks globally earlier in the day, with indexes up 6% in Tokyo, 2.5% in Paris and 1.6% in Shanghai.

The Nikkei 225 in Tokyo fell more than 3.9% before leveling off. About an hour after the market opened it was down 3.5% at 31,847.40.

South Korea’s Kospi lost 1% to 2,315.27, while the S&P/ASX 200 in Australia declined 2% to 7,359.30. Shares in New Zealand also fell.

Analysts have been warning to expect more swings up and down for financial markets given the uncertainty over how long Trump will keep the stiff tariffs on imports, which will raise prices for U.S. shoppers and slow the economy. If they last a long time, economists and investors expect them to cause a recession. If Trump lowers them through negotiations relatively quickly, the worst-case scenario might be avoided.

Hope still remains on Wall Street that negotiations may be possible, which helped drive the morning’s rally. Trump said Tuesday that a conversation with South Korea’s acting president helped them reach the “confines and probability of a great DEAL for both countries.”

On Tuesday, Japanese stocks led global markets higher after the country’s prime minister, Shigeru Ishiba, appointed his trade negotiator for talks with the United States following a conversation with Trump.

China said it will “fight to the end” and warned of countermeasures after Trump threatened on Monday to raise his tariffs even further on the world’s second-largest economy.

White House press secretary Karoline Leavitt said Tuesday that Trump’s threats of even higher tariffs on China will become reality after midnight, when imports from China will be taxed at a stunning 104% rate.

That would coincide with Trump’s latest set of broad tariffs, which are scheduled to kick in at 12:01 a.m. And Trump has made clear that he does not intend to have any exemptions or exclusions, according to the top U.S. trade negotiator, Jamieson Greer.

The U.S. trade representative also said in testimony before a Senate committee that roughly 50 countries have already been in contact, and he’s told them: “If you have a better idea to achieve reciprocity and to get our trade deficit down, we want to talk with you, we want to negotiate with you.”

Trump’s trade war is an attack on the globalization that’s shaped the world’s economy and helped bring down prices for products on store shelves but also caused manufacturing jobs to leave for other countries. Trump has said he wants to narrow trade deficits, which measure how much more the United States imports from other countries than it sends to them as exports.

___

AP Business Writers Stan Choe and Matt Ott contributed.

Copyright 2025 The Associated Press. All rights reserved. This material may not be published, broadcast, rewritten or redistributed without permission.