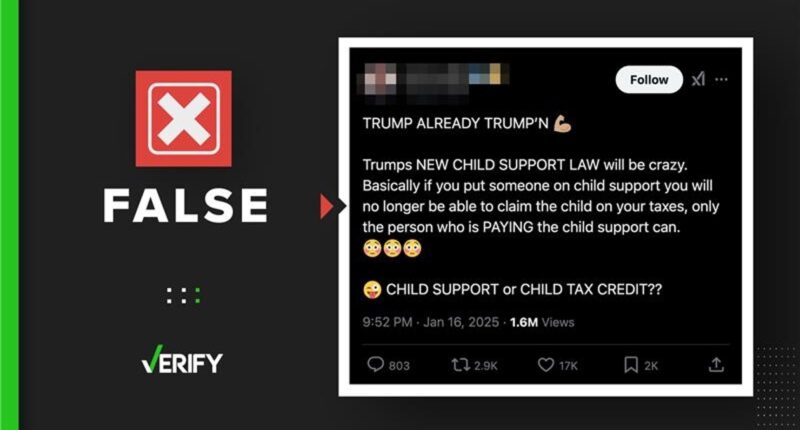

False claims online accuse President Trump of changing federal tax rules for claiming dependents in child support cases.

On Jan. 20, President Donald Trump became the 47th President of the United States after being sworn in. He wasted no time and on his first day in office, he executed 42 presidential actions, among which were the signing of 26 executive orders.

Prior to his inauguration, several viral videos spread across the internet, with claims that Trump would introduce a new law affecting how child support recipients could declare dependents on their tax returns.

One such video on TikTok, shared on Jan. 16 and garnering over 12 million views, alleged that Trump had announced a significant change stating, “Oh my God, Trump just tweeted if you put your baby daddy on child support that the baby daddy now gets all of the income tax.”

Another TikToker, whose video has more than 16 million views, says, “Trump passes insane new child support law. Patriots, if you don’t know about this, Trump passed a new law that whoever is paying the child support would get to declare those children on their taxes. So, say you’re a single father, single mother, and you are not the one paying the child support, you will not get the tax return for your child.”

Similar claims have been shared on X, Facebook, Instagram, Threads and YouTube. Many of these claims say Trump posted about the new law on social media.

Several VERIFY readers, including Kerri and Jeannie, asked us if those claims are true.

THE QUESTION

Did Trump pass a new law that would prevent child support recipients from claiming dependents?

THE SOURCES

THE ANSWER

No, Trump didn’t pass a new law that would prevent child support recipients from claiming dependents.

WHAT WE FOUND

Claims that Trump passed a new law preventing child support recipients from claiming dependents are false. Trump has not posted on social media or made any statements suggesting changes to the current child support tax law. In addition, his administration and presidential agenda also have not proposed such a law.

Even if Trump had proposed changes to the federal child support tax law, as the viral claims suggest, implementing them would not be as straightforward as announcing it on social media or even signing an executive order. Amending the tax code requires Congress to pass a bill modifying the Internal Revenue Code (IRC), the governing law of federal tax collection. That hasn’t happened nor has it been proposed.

These rules apply to federal taxes, but state laws may vary. For state-specific guidelines on custodial deductions, child support and dependent claims, you should check your state’s Department of Revenue or Taxation.

VERIFY reviewed Trump’s social media accounts and found no mention of any proposed law or changes on X or Truth Social, his primary platforms.

We also examined his Agenda47 website, which outlined his policy plans for a second term, and found no proposals related to this type of reform. The Republican Party’s platform also includes no recommendations.

According to the IRS, specific rules apply to divorced, separated, unmarried or co-parenting individuals who share custody of a child. Only one person can claim tax benefits for a dependent child per tax year. Generally, the custodial parent – the parent with whom the child lived with the majority of the year – claims the dependent. If the child lived with each parent equally, the custodial parent is determined as the one with the higher adjusted gross income.

The IRS also specifies that child support payments are not considered taxable income and also are non-deductible, the IRS says.

It’s unclear where the viral rumors started. VERIFY reached out to some posters who were among the first to share the claim, but didn’t hear back at the time of publication. VERIFY also reached out to the Trump administration and also didn’t hear back.