NYC subway stabbing leaves 2 injured

Two men were stabbed in the abdomen during a crowded subway train ride in New York City Wednesday morning, according to the police. (Fox 5 New York)

NEWYou can now listen to Fox News articles!

Police have arrested a man allegedly involved in a horrific stabbing that left two individuals injured aboard a crowded New York City subway train Wednesday.

Footage obtained by FOX 5 New York captured the attack that police said unfolded as the train pulled into Grand Central Terminal during the morning rush hour around 7:20 a.m.

Law enforcement located the suspect, identified as Gavin Ferguson, 30, who was accused of running from the scene after stabbing two men in the stomach. Ferguson now faces charges of attempted murder and second-degree assault.

A knife-wielding subway train passenger attacked two individuals near Grand Central Terminal in New York City Wednesday morning, police said. (Fox 5 New York)

Video of the incident appears to show the suspect cornering a man who climbed onto a train bench before getting stabbed at least twice. Fellow passengers seemed frozen in shock as they watched in horror from the sidelines.

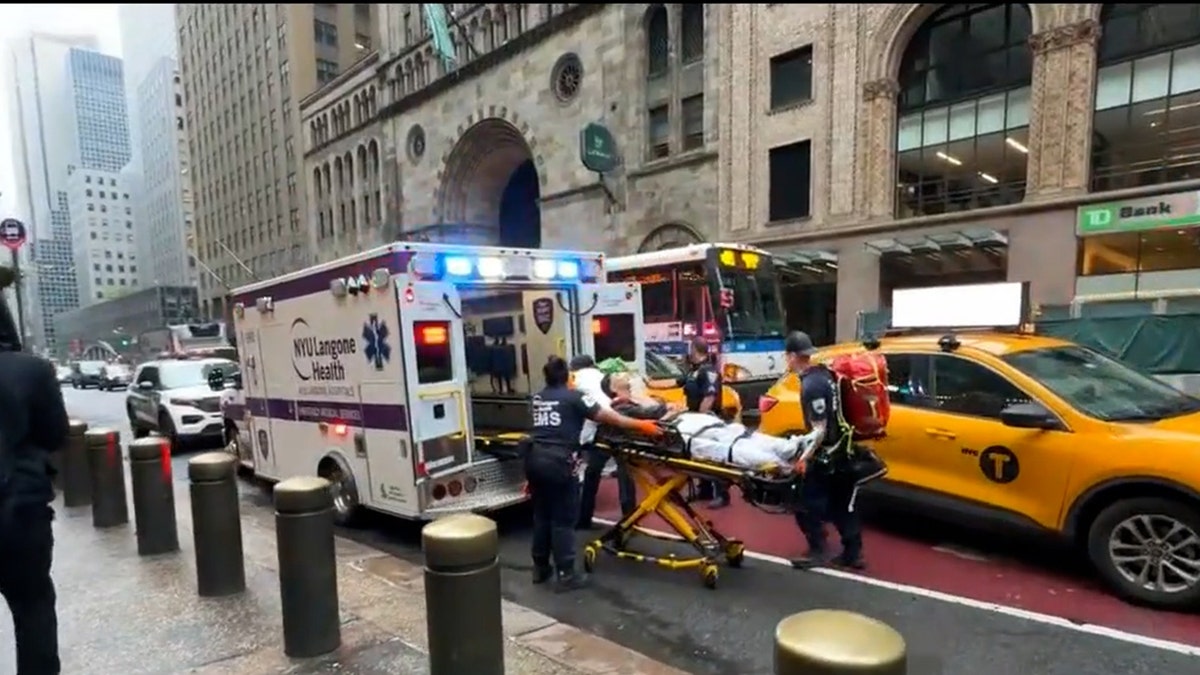

A man was taken to the hospital on Wednesday after being stabbed on board a crowded subway train at Grand Central Terminal in New York City. (Fox 5 New York)

Police said the suspect fled in an unknown direction following the attack, which stemmed from an argument.

Emergency Medical Services responded to the incident and both the victims were taken to the hospital in stable condition, police said.