Homeowners have gleaned countless design tips from Laurence Llewelyn-Bowen over the decades.

But could they learn from his inheritance tax planning methods as well?

This week, the interior designer and TV presenter disclosed that he and his wife Jackie have generously gifted two-thirds of their Cotswolds manor to their daughters, their husbands, and four young children.

‘I’m no longer the lord of the manor,’ he said.

So how did he do it – and could his methods help you cut your family’s inheritance tax bill?

Money Mail asked the experts.

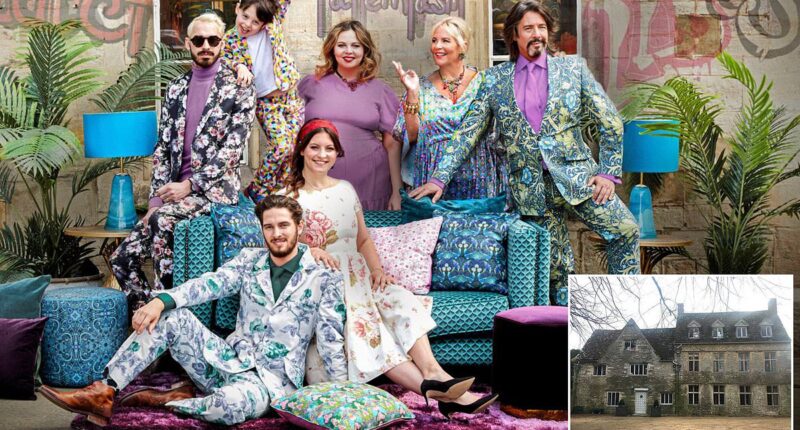

The heartwarming gesture: Laurence Llewelyn-Bowen and his wife Jackie have shared two-thirds of their Cotswolds manor with their two daughters, their husbands, and four young children.

What did Laurence do?

He described how the large property he bought in 2007 has been split into three sections.

His daughter Cecile, her husband and their two children live in a converted garage block.

The main home has been partitioned into two dwellings, according to The Sunday Times.

His other daughter Hermione lives with her husband and two children in one part and Llewelyn-Bowen and his wife in the other.

What is the advantage of this?

The family’s choice to embrace an intergenerational living arrangement seems to be a success for them. Additionally, according to wealth planners, there are likely to be advantageous inheritance tax implications arising from this decision.

That is because gifts made within your lifetime are free from inheritance tax, so long as you survive for seven years after making them.

But when you die, your estate is subject to inheritance tax at 40 per cent above your allowances (£325,000 per person, £650,000 for a couple and up to £1 million if passing on a family home to direct descendants).

By giving away part of the house now, Llewelyn-Bowen and his wife could cut the inheritance tax bill that would have to be paid by their family by hundreds of thousands of pounds.

Imposing: The TV star’s mansion is split in to three homes with two-thirds of the property being given to his sons-in-law

How do you cut the tax bill?

From a legal perspective, you can give away your home whenever you like. However, it may still attract inheritance tax when you die unless you do it in certain ways.

Julia Rosenbloom, private wealth tax partner at Shakespeare Martineau, says: ‘If you give away your home and keep living in it, it’s called a gift with reservation of benefit.

HMRC will consider that it’s not really a gift at all and therefore it’s still chargeable to inheritance tax in your estate when you die.’

To make sure this doesn’t happen, there are two main options.

One is to split your home into multiple dwellings, as Laurence appears to have done. Then, you can give away the ones that you do not live in.

The ones you have given away should fall out of your estate for inheritance tax purposes after seven years. However, this would need to be done properly and with good advice to make sure it adheres to the rules.

You would need to have proper partitions and self-contained homes, for example, each with their own front door, kitchen and bathroom.

‘Laurence and his family couldn’t just amble between residences, they would have to be clearly defined and separate,’ adds Rosenbloom.

You may also need planning permission and you are likely to end up paying separate council tax on each dwelling.

A second option is to split the property into multiple residences and give away all of them to your family. Then, you would have to rent the residence that you continue to live in from the new owners.

James Ward, a partner at law firm Kingsley Napley, says: ‘You would need to pay the owners market rent – and this needs to be done just as formally as if it were a commercial arrangement between strangers.’ The owners would have to pay income tax on the rent you pay them.

Are there other options?

In reality, few properties are large enough to be successfully split into independent dwellings. Ward says he does see it work, for example, in London townhouses or in properties where there are annexes, or converted basements that can be split off.

However, where a property can’t be split, there are other options.

Parents who plan to live with their adult children indefinitely may be able to give away a proportion of their property.

For example, you could give them 50 per cent and that element would no longer be considered part of your estate after seven years.

Let’s say you owned a family home worth £1 million and gave your child half. Their £500,000 share would not attract inheritance tax if you survive for another seven years.

That means that only your remaining £500,000 share would be considered part of your estate when calculating the inheritance tax due – and if you have no further assets, no tax may be due at all.

If you hadn’t made a gift, tax of 40 per cent would be due on the total above your £500,000 allowance for passing on a family home – amounting to a £200,000 bill.

The child does not have to be living there full-time, but you can’t just pretend they live with you. As soon as they move out, this set-up – known as ‘common occupation’ – is no longer valid.

Gift: Parents who plan to live with adult children indefinitely could give them 50% of a property which would no longer be considered part of the estate after seven years

What about other family?

Laurence revealed that instead of giving two-thirds of the property to his daughters, he gave it to his sons-in-law.

Faye Church, senior financial planning director at Rathbones, says that this can be risky as there are several things that could go wrong unless protections are put in place.

There are unlikely to be inheritance tax benefits as the amount of tax payable is the same regardless of who you leave assets to.

‘If you give property to your child’s spouse, it becomes theirs. There would be nothing to stop them, for example, leaving it in their will to someone else,’ she says. ‘Pre-nups can help, but there is no guarantee.’

Ward adds: ‘My recommendation would always be to be wary about gifting to son or daughters-in-law, particularly if that’s part of your home.

‘If they get divorced, the property could have to be sold and you could end up with neighbours. That might be okay if it’s family but you might feel differently if it’s strangers.

‘You can put an agreement in place that says, for example, you have first refusal for purchasing the property if it has to be sold.’

Giving away some or all of your home has many possible pitfalls. Expert advice should be sought to find the right decision for you.