Savers with larger pensions intend to splash out on more holidays to avoid a new inheritance tax levy, research reveals.

Pensions are going to become liable for death duties like other assets such as property, savings and investments starting in April 2027.

More than half of individuals over the age of 45 who have saved at least £300,000 for retirement intend to increase their spending to avoid inheritance tax, with indulging in vacations being their top priority.

Sharing experiences with loved ones, such as going on trips together, emerged as their second most cherished goal, followed closely by gifting to family members.

“The findings from our survey align with the increased inquiries we have observed since the Budget announcement in October,” noted Daniel Hough, a financial planner at RBC Brewin Dolphin.

‘Retirees and people approaching retirement are increasingly looking to spend more of their pension, rather than risk a big portion of it being lost to inheritance tax when they pass away.’

Added to the value of family homes, the raid on pensions will drag many more workers saving for retirement pots into having a potential inheritance tax bill.

While £300,000 is a substantial pension, those who have worked and saved through the era of defined contribution pensions, where they must build an investment pot to provide retirement income, will need more than this to be comfortable.

The Pension and Lifetime Savings Association’s benchmark figures say a moderate retirement for an individual would cost £31,300 after tax, excluding housing costs.

A £300,000 pension pot at an industry standard 4 per cent withdrawal rate would provide retirement income of £12,000 a year. Combined with a full state pension of £12,000 a year, this would bring total income of £24,000 before tax.

Hough adds: ‘The fact that the vast majority of respondents are planning to spend more on holidays is unsurprising – we’ve seen a number of cases where parents or grandparents have decided to pay to take the whole family away on five-figure trips so that they can experience something special.’

The Government said in the Autumn Budget that it is ‘removing the opportunity for individuals to use pensions as a vehicle for inheritance tax planning’ by bringing unspent pots into the scope of inheritance tax.

Only the richest 4 or 5 per cent of families currently pay inheritance tax, which is charged at 40 per cent on assets above the key thresholds – though that is expected to rise significantly when pensions start being counted towards the levy.

With frozen thresholds and higher property values also inflating inheritance tax bills, the Treasury is now predicted to rake in a total of £66.9billion between 2024 and the end of the decade, when the annual take will hit £14.3billion.

The Office for Budget Responsibility forecasts receipts of £9.1billion in the current tax year, rising to £11.7billion in 2027-2028, the first year that pensions become liable for inheritance tax.

The Government’s plan to impose inheritance tax on death benefits too has received far less attention, but could be even more significant to some grieving relatives.

> How to avoid paying IHT on your pensions

Some 56 per cent of middle-aged and older people with more than £300,000 already saved for retirement plan to spend more of their fund to stop it falling into the hands of the taxman, an RBC Brewin Dolphin survey found.

But 27 per cent don’t intend to change their plans, and 17 per cent didn’t know, according to the poll of 1,045 adults, one thousand of whom were aged 45-plus.

Among those who have decided to spend more, 75 per cent will take more holidays, 40 per cent will prioritise experiences with family, 39 per cent will gift more to family members, and 10 per cent will pay off mortgages or other debts.

Other objectives mentioned, but less frequently, were buying a new house, making home improvements and getting a new car.

RBC Brewin Dolphin cautioned that the inheritance tax changes for pensions are not scheduled until 6 April 2027, and detailed legislation has not yet passed so it is advisable to wait for that before making any significant spending decisions.

Hough says: ‘There is, of course, nothing wrong with wanting to live as full a life as possible and spend money on your family so that they remember having an incredible time with you.

‘But, there are also inevitably risks in doing too much of that. People need to be very careful not to go overboard and leave themselves short for the remainder of their retirement.’

He adds: ‘We would encourage people not to let the prospect of paying more in tax be the main driver behind any significant spending decisions or lifestyle changes.’

RBC Brewin Dolphin survey found 60 per cent of the wealthy pension savers it surveyed had either got financial advice already or planned to in future, but the rest would not do so.

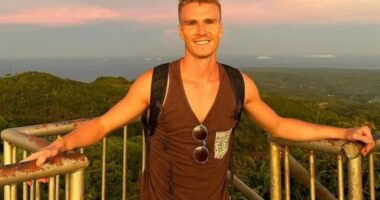

Where would YOU go? Many pension savers who can afford it plan to take more holidays to beat inheritance tax raid

How to reduce inheritance tax on pensions

Changes to inheritance tax don’t come in until April 2027, but people are being advised to review existing arrangements well in advance.

Some are looking to cash in as much of their pensions as possible while avoiding a big income tax bill – although it is better to avoid crystallising losses by making bigger pension withdrawals in market downturns.

Other options include gifting out of surplus income which remains inheritance tax free providing you can afford it, or buying life insurance and putting it in trust.

Some savers will be deciding whether to leave more or all of their estate to spouses – who can still benefit from estates free of inheritance tax – instead of their children to delay and minimise the eventual bill.

Wealth manager Evelyn Partners has suggested we could see a marriage boom or rise in civil partnerships among older couples as a result.

Evelyn’s financial planning partner Gary Smith suggests six ways to cut inheritance tax on pensions here.

SIPPS: INVEST TO BUILD YOUR PENSION

AJ Bell

AJ Bell

0.25% account fee. Full range of investments

Hargreaves Lansdown

Hargreaves Lansdown

Free fund dealing, 40% off account fees

Interactive Investor

Interactive Investor

From £5.99 per month, £100 of free trades

InvestEngine

InvestEngine

Fee-free ETF investing, up to £4,000 cashback

Prosper

Prosper

No account fee, dealing fee and 30 ETF fees refunded

Affiliate links: If you take out a product This is Money may earn a commission. These deals are chosen by our editorial team, as we think they are worth highlighting. This does not affect our editorial independence.

Compare the best Sipp for you: Our full reviews