BRITAIN was having a grim 1970s flashback last night with a debt crisis, the threat of strikes and an under-siege Labour Chancellor.

Rachel Reeves is under immense pressure to cancel a controversial visit to China scheduled for this weekend, as borrowing costs soar to levels not seen since the troubled tenure of Liz Truss.

The Chancellor’s tax-hiking Budget, which hammered employers with a steep national insurance rise, was blamed for the market turmoil.

Last night, Ms. Reeves received a cautionary message that her trip to the Far East could result in her becoming the next Kwasi Kwarteng—referring to Ms. Truss’s Chancellor who left the UK during the economic crisis of 2022.

This warning comes in the midst of a looming threat of industrial action reminiscent of the strikes in 1978 and the winter of discontent in 1979, with teachers considering the possibility of a walkout.

Economists also raised the prospect of a 1976-style debt crisis “nightmare” of the kind that forced Jim Callaghan’s Labour government to go cap in hand to the International Monetary Fund for a bailout.

They said the Chancellor’s wafer-thin £9.9billion headroom to keep the Government within its own borrowing rules was all but obliterated — opening the door to fresh tax rises or taking the axe to public spending.

It tees up a brutal slapdown for the Chancellor from watchdog the Office for Budget Responsibility when it gives an official update on the state of the economy on March 26.

The Treasury insisted there was “no need for an emergency intervention” as it sought to soothe concerns over Britain’s shaky financial markets.

But the pound yesterday tumbled to its lowest level in 14 months, dropping to $1.23 against the dollar.

The Sterling sell-off was significantly worse than every other major global currency.

The Tories hammered Ms Reeves, suggesting that she be sacked over the fall-out of her October Budget.

Shadow Home Secretary Chris Philp told our Never Mind The Ballots show: “I think the Chancellor should stay in the UK fixing the mess her Budget has created.

“Bond yields are higher than when Kwasi Kwarteng got sacked.

“The whole government should be fired, frankly, including Rachel Reeves, because they jacked up taxes, they crushed pensioners, they’re crushing farmers.

“They’re crushing businesses with their high taxes.

“And this is the result, because the bond market can see that our economy is being squashed by this Labour government.”

Economists said that the pound has partly suffered from the dollar’s strength — but its weakness against other currencies suggested there was a “capital flight” away from the UK.

Typically, currencies rise when government bonds fall.

But Martin Weale, a former Bank of England rate-setter, said: “We haven’t really seen the toxic combination of a sharp fall in Sterling and long-term interest rates going up since 1976.

“That led to the IMF bailout.”

Mr Weale, now professor of economics at King’s College London, added: “So far we are not in that position but it must be one of the Chancellor’s nightmares.”

The interest charged on 30-year government bonds yesterday continued to edge up to 5.4 per cent, their highest level since 1998.

The government issues bonds, known as gilts, when it needs to raise money.

The interest on them is called yield.

When the price of the bond falls, the yield increases to reward an investor for the extra risk of holding a cheaper asset.

But the yield on benchmark ten-year gilts has hit 4.86 per cent, the highest since the global financial crisis of 2008.

High street banks use ten-year gilt prices to set mortgage rates, suggesting families face expensive home loans for even longer.

Investors worry this will squeeze income further and cause a slump in spending and economic growth.

While there is a global bond market sell-off, the pain is even greater in the UK where there is a wafer-thin spending buffer.

Analysts estimate that the recent surge in the bond yields has added almost £9billion in public borrowing costs.

This will virtually wipe out Ms Reeves’ £9.9billion buffer.

But Treasury Minister Darren Jones claimed the markets were functioning in an “orderly way”.

Adding to the 1970’s-style woe, the National Education Union said it will hold an online ballot on industrial action over government proposals for a 2.8 per cent pay rise.

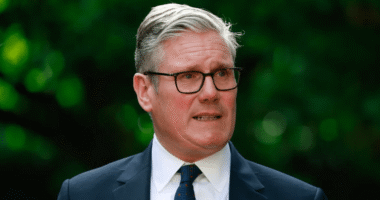

But a spokesman for PM Sir Keir Starmer urged the union to “put pupils’ interests first”.

Word not her bond

By Ashley Armstrong

GOVERNMENT bonds are back in the headlines — in bad news for the economy and the Chancellor.

Rachel Reeves built her run-up to No 11 on the very promise she would be the safe opposite to Liz Truss’s market meltdown.

Comparisons to 2022’s gilt crisis are slightly overdone.

The bond sell-off has not been as sudden, or required the Bank of England to step in — yet.

But more worryingly, experts are comparing it to the nightmarish 1970s because the Pound is being punished as well.

It suggests global investors are taking a very dim view of Reeves’ Budget and the UK’s hopes of growth.

A weaker Pound means surging interest demands on ten year government bonds.

These are used by high street banks to price mortgages and suggest we will suffer more expensive home loans for longer.

Squeezed household finances will stifle spending and depress growth.

So much for Reeves’ promised “Securonomics”

Where’s Rachel?

By Ryan Sabey

CHANCELLOR Rachel Reeves was ridiculed over the market turmoil last night by critics who demanded to know: “Where’s Wally?”

She was attacked for not turning up to the Commons for a debate on the crisis — while mock-ups of her in a red-and-white Wally outfit appeared on social media.

Her deputy, Darren Jones, stood in for her as she left for a trade trip to China.

Shadow Cabinet minister Andrew Griffith said: “At this critical moment, the Chancellor didn’t show up. Where is Rachel?”

Former party chair Sir Jake Berry shared an image on X of Ms Reeves looking in the mirror — and seeing a reflection of Liz Truss.

In the post, Sir Jake said: “Mirror, mirror on the wall, who crashed the bond markets worst of all?”

Former PM Ms Truss was forced out of Downing Street following an economic meltdown after her mini-Budget saw mortgage rates increase for many homeowners.