With US property prices still climbing, potential homebuyers are increasingly concerned about a housing market crash.

They fear buying at record-high prices, only to see them plummet in the coming months or years when the real estate bubble bursts.

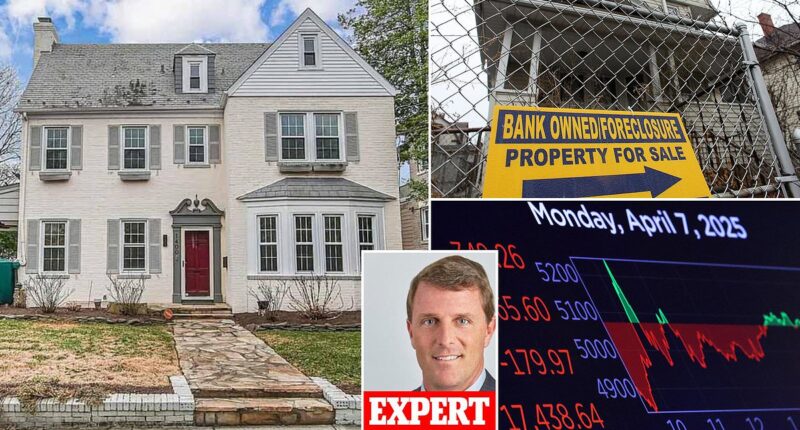

This issue is exacerbated following the stock market decline brought on by President Donald Trump’s tariffs, which was comparable to the crash experienced in 2008 when the previous property market collapse commenced.

Following a surge in housing prices that started during the pandemic, prices peaked at $398,400 in February 2025 — the highest level ever recorded for that particular month by the National Association of Realtors, representing an increase of nearly 4 percent from the previous year.

The stock market was also at record highs February, and is now down about 20 per cent.

However, according to Jeff Ostrowski, a housing market analyst at Bankrate, in an interview with DailyMail.com: ‘In contrast to stocks that are constantly traded and revalued, housing is not easily liquidated, and prices tend to remain relatively stable, to borrow some economic terminology.’

‘The turmoil of the past few weeks doesn’t affect the underlying fundamentals of the housing market.’

Meanwhile, Ken H. Johnson, a housing economist at the University of Mississippi, says home values have stretched the bounds of affordability to the breaking point — and are at a tipping point.

In addition to high prices sticking around, experts predict mortgage rates will remain high

Greg McBride, Bankrate’s financial analyst

‘Today, home prices — while moderating a little — are significantly above predicted homes prices based on a history of past sales, while mortgage rates remain high,’ Johnson says.

‘Does all of this mean we will have a significant decline in home prices?

‘Probably not. Unlike the last housing crash, the nation is in the grips of a housing shortage, preventing a major decline in home prices.’

Realtors say prices are unlikely to fall anytime soon, as there are still too few homes on the market to meet demand.

Homeowners who locked in ultra-low three percent mortgages are holding off on selling, since moving would mean switching to a higher rate.

‘You are seeing more supply coming on market, and houses taking longer to sell,’ says Greg McBride, Bankrate’s chief financial analyst.

‘We’re going to see pretty tepid home price appreciation going forward.’

In addition to high prices sticking around, experts predict mortgage rates will remain high. Under Donald Trump the federal deficit is likely to grow significantly.

Housing experts agree that even if prices do fall, the decline will not be as severe as the one experienced during the Great Recession

Ken H. Johnson, a housing economist at the University of Mississippi

‘To pay interest on the mounting federal debt, the government has to issue more Treasury bonds,’ says Lisa Sturtevant, chief economist at Bright MLS.

Mortgage rates fell to 6.2 percent in 2024, but they’ve moved back up, despite three Fed rate cuts to close out the year. The average rate for a 30-year fixed mortgage in Bankrate’s weekly survey released April 2 was 6.67 percent.

Reducing immigration could also hurt the labor supply needed for building new homes. About 31 percent of construction-trade laborers are immigrants, according to data from the National Association of Home Builders.

Also, the administration’s new tariffs will increase prices on crucial homebuilding supplies, and those will likely be passed along to the consumer to pay.

With the housing market this bad, potential buyers are wondering if it all ends in a housing crash. Experts all agree – things are bad, but it’s not likely.

Dave Liniger, the founder of real estate brokerage RE/MAX, says the sharp rise in mortgage rates has upset the market. Many would-be buyers had been waiting for rates to drop. If mortgage rates do come down, it could send a rush of new buyers flooding into the market, pushing up home prices.

‘You’ve got an entire generation of pent-up demand,’ Liniger says.

‘We’re in this fascinating position of tremendous demand and too little inventory. When interest rates do come down, it’ll be another boom-and-bust cycle.’

The Washington DC housing market is in a standstill due to local employees dealing with Department of Government Efficiency cuts

Housing experts agree that even if prices do fall, the decline will not be as severe as the one experienced during the Great Recession, because homeowners’ personal finances are much stronger today than they were 15 years ago. The typical homeowner with a mortgage has stellar credit, a ton of home equity and a fixed-rate mortgage locked in.

Inventory is too low for a crash.Builders aren’t building quickly enough to meet demand, so a repeat of the overbuilding of 15 years ago looks unlikely.

‘The fundamental reason for the run-up in price is heightened demand and a lack of supply,’ says McBride.

‘As builders bring more available homes to market and more homeowners decide to sell, supply and demand can come back into balance. It won’t happen overnight.’

There’s strong demand for homes on many fronts, especially with the rise of remote working.

Millennials are a huge group and in their prime buying years, and Hispanics are a growing demographic also wanting to buy homes.

And lending standards are stricter than they were back in 2007, when many borrowers didn’t even need to document their income for a loan.

Lenders offered mortgages to just about anyone, regardless of credit history.

More than 25,000 rental properties and 9,800 homes are listed in the DC Metro area

Today, lenders impose much tougher standards, and now, the median credit score for new mortgage borrowers in mid-2024 was 772, the Federal Reserve Bank of New York says.

‘If lending standards loosen and we go back to the wild, wild west days of 2004 to 2006, then that is a whole different animal,’ says McBride.

‘If we start to see prices being bid up by the artificial buying power of loose lending standards, that’s when we worry about a crash.’

Foreclosures are also down. In the years after the housing crash, millions of foreclosures flooded the housing market, depressing prices. That’s not the case now. Most homeowners have a comfortable equity cushion in their homes.

So, while home prices are pushing the bounds of affordability, it likely will not end in a crisis.

Meanwhile, the housing market in Washington DC is currently in a standstill as federal employees’ cushy salaries are under threat by Department of Government Efficiency (DOGE) cuts.

More than 25,000 rental properties and 9,800 homes are listed in the DC Metro area, with nearly 10,000 rentals and 500 homes just in the District of Columbia alone as of early April, according to Zillow.

And although Spring is always a hot time on the market for sellers, buyers are hesitant to snap up homes as the local job market is uncertain.