There’s been a flurry of executive orders today (Tuesday), some already raising the ire of the Left and so-called watchdog groups who don’t want their grifts to go away. Looking at you, Stacey Abrams. This Executive Order, Modernizing Payments To and From America’s Bank Account, appears to be passing under the radar; or maybe everyone is just too weary to care.

Here’s the skinny:

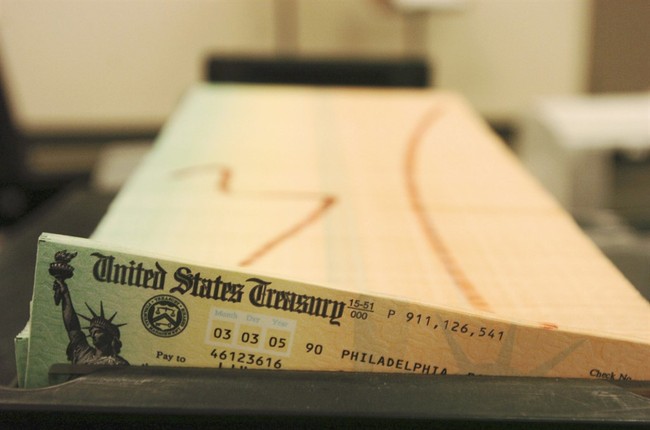

President Trump signs an Executive Order enabling the U.S. Treasury to modernize its payments system, in order to reduce waste, fraud and abuse:

– Gets rid of all of the 47 “independent” payment systems and centralizes.

– Makes use of the Do Not Pay list of fraudulent entities… pic.twitter.com/H7CsFhKRy7

— America (@america) March 25, 2025

This order promotes operational efficiency by mandating the transition to electronic payments for all Federal disbursements and receipts by digitizing payments to the extent permissible under applicable law (but not, for avoidance of doubt, to establish a Central Bank Digital Currency).

Here is where the administration may be shading the truth. The mere step toward electronic-only interfaces leaves the door wide open to the federal government acquiring the capabilities to monitor Americans’ accounts in any way, shape, or form, and also makes it easier to transition to a unified digital currency. Just because the Trump administration has held the line on not establishing CBDC doesn’t mean that some administration (Republican, Democrat, or otherwise) won’t go down that road.

But in the name of cutting fraud, becoming more nimble and efficient, and ensuring payments are generated appropriately, this could be a slippery slope.