Oil executives are cautioning that the energy boom in America has come to a halt due to the impacts of Trump’s tariffs and the decline in crude prices precipitated by Saudi Arabia’s ramped-up production.

The recent shale revolution had brought about a significant supply of affordable oil and gas, which had a transformative effect on the US economy, reducing its reliance on foreign oil from countries like Iran, Russia, and Venezuela.

Production hit record highs under President Joe Biden, but is now falling under Trump.

The situation presents a direct contradiction to the President’s pledges to ‘drill baby drill’ and assert America’s ‘energy dominance.’

Trump’s aggressive trade policies have pushed up the prices of vital materials needed for oil production such as steel, aluminum and casing.

At the same time, oil prices are tumbling because the OPEC cartel has decided to flood the market by increasing production.

OPEC, a consortium of oil-producing nations including Saudi Arabia, the UAE, and Iraq, collaborates to influence the global oil market in order to enhance profitability.

Riyad’s shock decision to pump more oil in recent months will threaten America’s share of the global oil market, Scott Sheffield, the former head of shale driller Pioneer Natural Resources, told the Financial Times.

‘Saudi is trying to regain market share and they’ll probably get it over the next five years,’ Sheffield explained.

US producers are abandoning rigs as oil prices tumble, making them unprofitable

US shale producers need oil prices of around $65 a barrel to break even, according to the the Federal Reserve Bank of Dallas.

But prices are currently $61.53 a barrel, down 23 percent from this year’s high point.

US shale producers, such as ExxonMobil and Chevron, are slashing capital expenditure by about $1.8 billion for this year, abandoning rigs, and slashing jobs.

Chevron and BP have between them announced 15,000 job cuts across the globe.

Bosses have warned the worst is still to come.

‘In this environment, we drop the rigs and buy back stock,’ Travis Stice, chair and CEO at Diamondback Energy, told the Financial Times.

The west Texas-based producer warned earlier this month that US production has now peaked as oil prices continue to slide.

‘Every single conversation I’ve had is that this oil price won’t work,’ Stice warned.

Trump has promised to assert America’s ‘energy dominance’ but production is falling

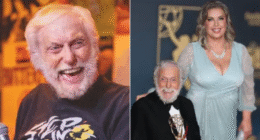

Oil bosses Travis Stice (left) and Clay Gaspar (right) warned that US production is in trouble

US oil output is expected to fall 1.1 percent in the next year

An oil pumpjack in a field on April 8, 2025, in Nolan, Texas

Other bosses have also laid out the reality of higher costs and lower profits.

‘We’re on high alert at this point,’ Clay Gaspar, CEO at Devon Energy in Oklahoma City, told investors earlier this month.

‘Everything is on the table as we move into a more distressed environment.’

US oil output is expected to fall 1.1 percent in the next year, according to S&P Global Commodity Insights.

This would mark the first annual decline in a decade, excluding 2020 when the pandemic collapsed demand and prices.

This triggered a wave of bankruptcies across Texas and North Dakota.