The patient is asking for clarification on what they owe and have already paid, as they are seeking grants and are in a financial bind, unable to even afford groceries. They express concern about missing tax payments on their home but are committed to not neglecting their financial obligations.

The individual in question is married to a cancer patient receiving treatment at the City of Hope Cancer Hospital in Duarte. Initially, there was no intention to work specifically with cancer patients, with a belief that such cases would not reoccur after passing board exams.

About a decade ago, a call was received regarding a young woman only a few days older who lived nearby the caller’s parents. She was diagnosed with aplastic anemia and depended on regular blood transfusions to survive. This marked the beginning of a journey to assist patients, with the number of City of Hope patients aided over the years exceeding 2,000.

Insurance is a catch-22. It almost seems like you’re punished if you use it, but you’re a fool not to have it. I would love to respond to the email above with, “Don’t worry, I’ll take the loss, and your husband’s health is more important than money.” However, per insurance requirements, legally I cannot.

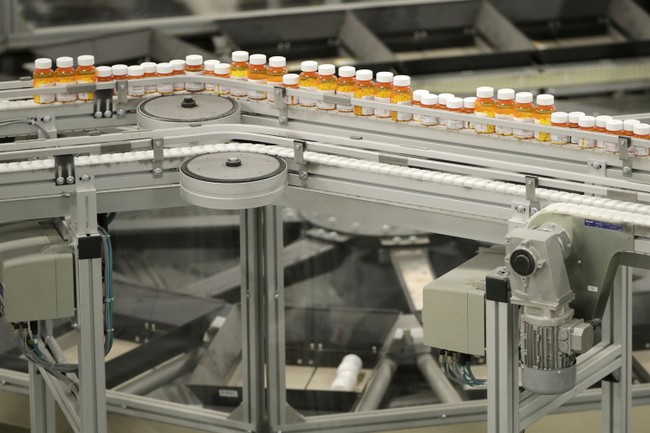

In the pharmacy industry, audits by the insurance companies are routine. During an audit, they will ask to see the prescription the insurance company paid for in regards to accuracy. Is the right doctor typed? Right drug? Strength? Quantity of pills? Refills? They even ask how the prescription originated, meaning did it come electronically, by paper, or by fax? True story: If I denote in the system that the Rx came as paper, but it was really done electronically, they will take $10 from me for that “error.”

Even more invasive requests occur; namely, they will ask to see that the patient paid the copay. Yes, the insurance company will ask to see that the patient paid their copay either by canceled check, credit card receipt, or if by cash, to see that cash was deposited into your business bank account. If you can’t prove the patient paid, they will take the money back on that claim (even though the medication was dispensed), and they can terminate the contract with the plan, meaning you won’t get access to take care of patients in the network. All if you don’t collect copays, regardless of the patient’s financial struggles, such as above. The amounts vary. I’ve seen copay requests for $1.50, and I’ve seen them for hundreds, if not thousands, of dollars. In cancer care, in particular, costs add up quickly. All the expenses that go to a deductible include doctor visits, treatments, chemo, outpatient meds, etc. What insurance doesn’t cover is the hidden costs such as travel and housing.

Aside from solid tumors, we take care of patients who have had bone marrow transplants as a result of a diagnosis of leukemia. Once a transplant has occurred, the patient basically gets a whole new immune system, pretty much like a newborn baby. The transplant date acts as a new “birthday.” Patients have to stay local to the hospital and have to be isolated while they get vaccines and allow for the immune system to strengthen. Insurance doesn’t cover that. It also doesn’t cover having rooms that sometimes don’t have refrigerators. This means spending hundreds of dollars a day on food to eat.

I’ve seen patients have to sell their homes to afford cancer care, I’ve seen patients live in their cars or campers, and I’ve seen patients quite literally have to choose between life and death as a result of insurance not covering certain medications they deem not necessary. I’ve had patients come to the counter to take medication to prevent infections after transplant, and the insurance thinks that having had a bone marrow transplant isn’t good enough to pay for this item. The antifungals in question range from $500 to $5,000 for a one-month supply.

The times the insurance does cover the medication, it comes as a loss to me, meaning the insurance pays me below my cost. Chain pharmacies will and have refused these patients and turned them away. I’ve never had the heart to refuse a single patient as a result of under-reimbursement. I personally don’t think it’s right to make patients have to face this decision. I’m lucky in that my business is thriving. Meanwhile, one-third of all pharmacies in the country today are closing as a result of these under-reimbursing practices by medical insurance companies. Just today, I read a report that Anthem Blue Cross/Blue Shield was ready to stop covering anesthesia at a point they deemed “not medically necessary.” Talk about crazy. These medications aren’t a light switch you can turn on or off, and of course, the cost would be astronomical, meaning patients who require necessary surgeries would be hesitant to have them. After enough backlash, it seems they have revoked their previous stance.

I have tried to put my experiences into meaningful reform. I helped a state assembly member in Oregon write a few bills that would regulate insurance companies. They were HB 2725 and HB 3013. The most important — the one that made insurance companies register with a license that could have action taken against it — was HB 2725. We fell one vote short after the insurance lobby got in a state senator’s ear and told lies for them to remain unregulated.

I have heard arguments for “Medicare for All.” I have heard of a private vs. public healthcare angle as the Canadians have, and I have even studied other insurance measures throughout the world. While I know the costs that come with insuring everyone, having insurance doesn’t mean anything if huge costs are pushed onto everyone in the form of either a heavy monthly deductible or the required increased taxes to pay for it.

I can’t say that I know all the answers, but what I can say definitely is that what we have now isn’t working. I think the assassination of Brian Thompson is sparking a renewed conversation about healthcare in this country, with many venting their frustration about it. I, for one, understand it firsthand.