A DEVASTATED woman is picking up the pieces after a single phone call about an issue with her Social Security number led to her losing $35,000.

The Alabama resident feared she would lose everything if she didn’t cooperate with the manipulative caller.

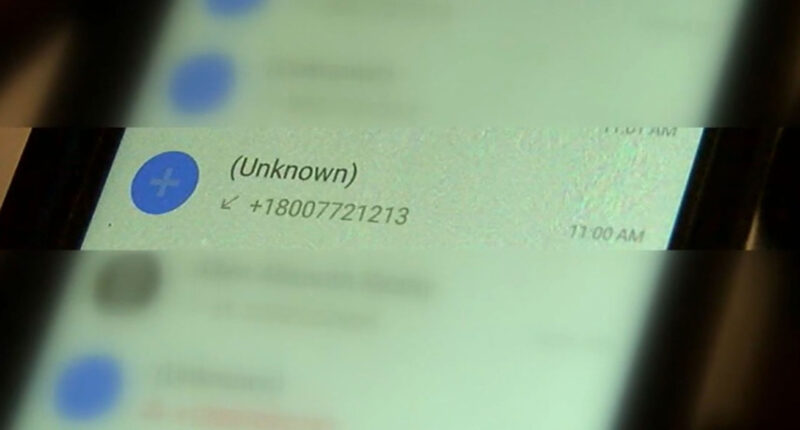

The woman, who lives in Pelham outside Birmingham, told Fox affiliate WBRC that she was first called on October 1 by someone she thought was Amazon.

The caller asked whether she had just purchased a new iPad for $1,400, and she responded that she had not.

This led to a series of calls with other bogus officials who claimed they were from the Federal Trade Commission.

One day, a terrified woman received a call claiming her money was being stolen and used for a money laundering scheme due to an issue with her Social Security number.

She briefly spoke with someone she thought was Wells Fargo before being sent masterfully designed fake forms from the same FTC people.

“It was the paperwork that convinced me or had me believing that it was for real,” she said.

The scammers tried to convince the poor woman that she was at risk of prosecution for her unfounded involvement with the money laundering crime.

They left her constant voicemails with threats, saying she would be evicted from her house if she didn’t act soon.

Finally, she was broken down. The FTC callers convinced her to hand off $35,000 in cash outside her home as “cooperation” with the investigation.

Now, she lives in fear that the scheming criminals know where she lives, and because she paid in cash, she will never get a cent of the $35,000 back.

Scammers use terrifying phone calls to extort people’s money daily, but they all make mistakes that expose their evil intentions.

Pelham Police Department Detective Todd McCann said any government agency requesting money is a massive red flag.

The caller further explained that legitimate entities like the “police department, county government, state government, or federal government” would never demand payment over the phone.

“Especially unusual payments like Venmo, wire money, gift cards, Bitcoin,” he told the outlet.

It is always recommended that if a consumer receives an unsolicited call from a bank or government agency, they should hang up and independently verify the caller’s identity by dialing the official phone number listed on the organization’s website.

Then, speak with a fraud expert at the company to see whether the call was legitimate.

Expert Advice: How to protect yourself from fraud

Craig Costigan, the CEO of fraud experts NICE Actimize gave the following tips to readers of The U.S. Sun on how to stay safe from fraudsters.

- As the saying goes, trust but verify. Always question your text and email communications. It may not be from who you think it is. Look for giveaways that it is a scam email. If your bank contacts you about a fraud via a text or email, call the number on the back of your credit or debit card to contact the fraud department directly – much safer than giving data to an impersonator.

- Protect your personal identifying information such as social security cards, your blank checks and other IDs.

- Always be vigilant. Even the safest and most careful among us have encountered fraudsters – we survived

because we reported the activity immediately to our providers, changed our passwords and checked our credit reports for unusual activity.

- If you are not applying for credit, you might also consider placing a freeze on your credit reports, such as Experian, TransUnion and Equifax, so fraudsters can’t open accounts in your name. You can easily unfreeze your credit when you want to open a new account.

COLD CALLS

Consumers should know that more than 33 million scam calls are made to American telephones each day, according to the National Consumer Law Center.

However, this is just one way fraudsters can snatch money from unexpecting citizens.

Another scam victim lost $135,000 after writing a check for home renovations.

The Air Force serviceman hired a couple to do some work on his new home.

However, as soon as the pair got cash, they quickly skipped town.