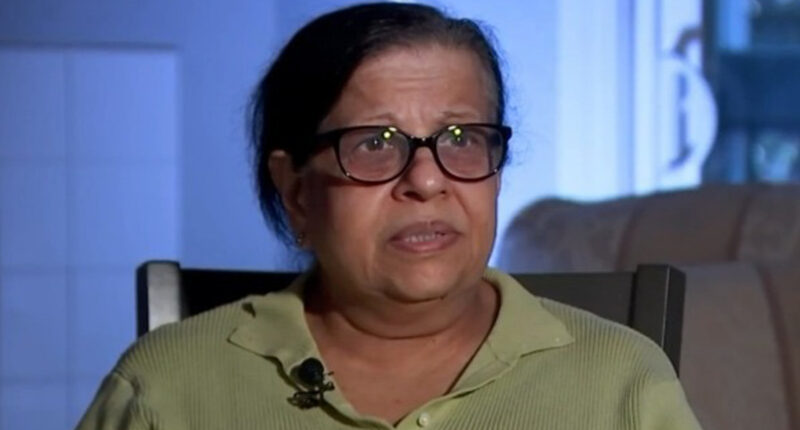

CRUEL fraudsters have conned an elderly woman out of $400,000 after she and her husband had cleared their debts.

The devious ploy involved a mystery charge on her Apple account.

Khomeini and her husband, who is suffering from dementia, had saved $400,000 for their retirement. Unfortunately, their entire savings were stolen, leaving the family in a dire situation.

Khomeini told NBC News that the swindle started with a text message.

The distraught woman said on Saturday, “I can’t sleep, I just feel terrible doing what he asked me to do.”

The incident started in October last year when Khomeini received a text message informing her about an attempt to purchase adult content using her Apple account. The message instructed her to contact a specific number promptly.

Khomeini said, “I called, which I shouldn’t have.”

The fraudster ordered her not to hang up, and said that someone was purchasing porn under her name, before telling her to “get ready.”

She asked “who are you?” And he said that he was an official representative who was going to “help.”

The thief took advantage of the situation, accessing the funds that the couple had diligently saved for their future after selling their house in California’s San Francisco Bay Area.

The sale meant the couple was out of debt for the first time since immigrating to the United States.

They used Patelco Credit Union, Citibank and Bank of America.

The money was also supposed to help her with her husband’s dementia care.

But it appears it might be too late to retrieve it, along with the couple’s expensive jewelery and gold bars that Khomeini was ordered to buy.

The fraud took place over several weeks, she said.

First of all, she was told to withdraw tens of thousands of dollars.

“He told me to drop $25,000 the first time,” a sobbing Khomeini recalled.

Don’t tell your husband anything – he’ll be in danger – don’t talk to your children, they’ll be in danger

She was instructed to download remote access apps, and to exchange cash into gift cards or gold bars for pickup.

The mom was also told to clean out her security deposit box full of family heirlooms.

She was told a lie, that it would all be going into a “gold account” where it would be protected.

NBC reported that, “On most days, they’d keep her on the phone for seven to eight hours, using fear, to keep her from telling others.”

Khomeini said: “They’d demand, ‘just follow my instructions, don’t talk to anybody.

“‘Don’t tell your husband anything, he’ll be in danger, don’t talk to your children, they’ll be in danger.'”

The petrified woman finally spoke about her ordeal to her daughter in early December – who immediately realized she’d been scammed.

The mom said she couldn’t understand how she got trapped as she had previously been so “careful with our money and savings.

“It’s just gone, everything’s gone.”

She said that “it could be more than $400,000 taken as the jewels were worth a lot.”

Police detective Lee Lawrence told NBC that, “Unfortunately at this point, it looks like we’re reaching a dead end.”

He said that nearly all the scams he’s investigated led to thieves living outside the U.S.

One consumer expert told the broadcaster that scam victims “should forget the shame and think about undoing it as quickly as possible – you might be able to get your money back.”

Scams and how to avoid them

Four signs that it’s a scam:

- Scammers PRETEND to be from an organization you know – they might use a real name, like the FTC, Social Security Administration, IRS, or Medicare

- Scammers say there’s a PROBLEM or a PRIZE – they might claim you’re in trouble with the government/you owe money/someone in your family had an emergency/or that there’s a virus on your computer. Some scammers say there’s a problem with one of your accounts and that you need to verify some information.

- Scammers PRESSURE you to act immediately – scammers want you to act before you have time to think

- Scammers tell you to PAY in a specific way – they often insist that you can only pay by using cryptocurrency, wiring money through a company like MoneyGram or Western Union, using a payment app, or putting money on a gift card and then giving them the numbers on the back of the card

How to avoid scams:

- Recognize scam attempts and end all communication with the perpetrator

- Search online for the contact information (name, email, phone number, addresses)

- Resist the pressure to act quickly

- Call the police immediately if you feel there is a danger to yourself or a loved one

- Never give or send any personally identifiable information, money, gold or other precious metals, jewelry, gift cards, checks, or wire information to unverified people or businesses

- Disconnect from the internet and shut down your device if you see a pop-up message or locked screen. Pop-ups are regularly used by perpetrators to spread malicious software. Enable pop-up blockers to avoid accidentally clicking on a pop-up

Sources: The Federal Trade Commission and the FBI

A spokeswoman for Patelco said she was unable to comment as there was a “sensitivity here that precludes Patelco from discussing specific member account information.”

However, she suggested she would continue to work with the credit union’s fraud team on the case.

Citibank rejected Khomeini’s claims, telling her in a letter, “it appears that you fell victim to a fraudulent scheme over which Citibank has no control, and we are unable to reimburse you or the transactions(s) since we found that no bank error occurred.”

The Bank of America told her in a letter that it would look into her fraud claim.

It also asked her to sign a scam victim acknowledgement – which her family said it was not comfortable doing, after reading the fine print.

OLD AGE

Khomeini added: “I just wish that they [scammers] don’t do this to anybody else.

“It’s our old age and we need the money. We can’t work and that’s the only money we had.”

Apple’s website has plenty of advice on how to avoid being a victim of such crimes.

It said, “Scammers use any means they can to trick you into sharing information or giving them money, including scam phone calls or voicemails that impersonate Apple Support, Apple partners and other well known or trusted entities or individuals.

“If you’re suspicious about an unexpected message, call or request for personal information, such as your email address, phone number, password, security code or money, it’s safer to presume that it’s a scam – contact that company directly if you need to.”