Water companies in England and Wales paid £2.5bn in dividends and added £8.2bn to their net debt in the two financial years since 2021, according to research by the Financial Times.

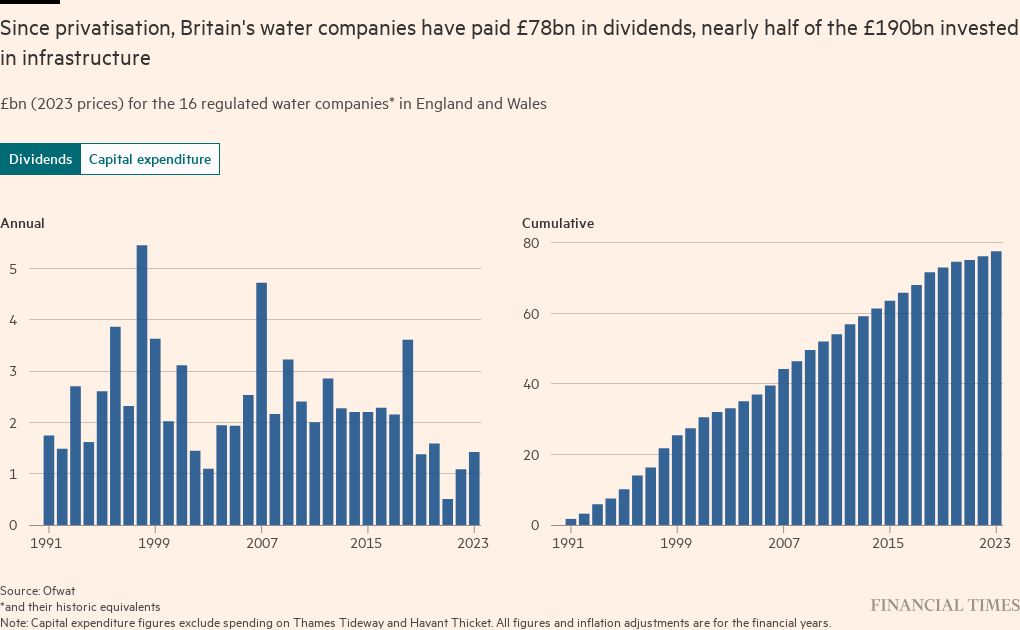

The updated figures mean that the 16 water monopolies have paid out a total of £78bn in dividends in the 32 years between privatisation in 1991 to March 2023, according to the research, which is based on regulatory data and then adjusted for inflation.

The £78bn payout is nearly half the £190bn the companies spent in the same three decades on infrastructure. The utilities meanwhile chalked up more than £64bn net in debt over the same period, despite being sold at privatisation with no borrowings.

The research comes amid fears that the financial crisis at the UK’s largest water utility, Thames Water, may spill over to other companies. Its parent company defaulted on debt earlier this month after its investors baulked at having to plough more money into the utility.

Other debt-laden water companies are wrestling with higher financing costs on borrowings, as well as historically steep construction, energy and labour prices. Meanwhile, a political and public outcry has erupted over service quality and pollution.

“Thames Water is a canary in a gold mine,” said one water company investor. “You’ve got the biggest water company teetering on the brink and we are all watching. It’s all the investors are talking about.”

South East Water, SES Water and Southern Water are all under close watch by regulator Ofwat over their financial stability. Southern Water was rescued from the brink of bankruptcy in an Ofwat-brokered deal with the Australian infrastructure manager Macquarie in 2021 but the utility was forced to suspend external dividends until at least 2025 following a credit rating downgrade last year.

Investor jitters come as Ofwat is pushing them to inject more cash into the utilities. It is not clear whether investors — which include sovereign wealth funds, private equity firms and pension funds — will play ball. Few equity injections have been made since privatisation.

Thames Water, for example, had received no new equity since privatisation until it received £500mn in the form of a loan bearing 8 per cent interest from parent company Kemble.

“It’s just not the model they’re used to,” said Adam Leaver, professor of accounting at Sheffield University. “They invested in a company they thought would use borrowed money. They weren’t expecting to inject cash of their own. Now the companies have too much debt, they haven’t invested enough in infrastructure and some of the more recent shareholders are screwed.”

Ofwat wants to lower utilities’ debt. It is pushing them to reduce gearing — a measure of debt to assets — from a sector average of around 68 per cent to 55 per cent by April 2025.

Peter Hope, head of regulatory finance at Oxera Consulting, said water companies will need to change how they run their finances in the next few years, given the step change in investment that is expected. “In broad terms, the industry will have to go from a situation of not having retained any earnings since privatisation, to having to retain for the next 25 years almost all of the earnings.”

In addition they will have to inject £5bn equity by 2030, and £8bn in the five-year period following, according to his calculations based on the 55 per cent gearing ratio assumed in Ofwat’s modelling. “Even this does not take into account the need for future increases to replace aged assets and deal with resilience and climate change,” he added.

Northumbrian Water, Yorkshire Water, Thames Water and Southern Water declined to comment. Dŵr Cymru, South East Water, SES Water, United Utilities, Affinity Water, Anglian Water, Bristol Water, Portsmouth Water, Severn Trent, South Staffordshire, Sutton & East Surrey Water and Wessex Water did not reply to requests for comment.

Water UK, which represents the industry, said investors have pledged to inject £6.5bn in new equity as well as raising debt as part of their £96bn investment plan by 2030. Investors’ willingness to finance the plan relies on a decent regulatory settlement, it added.

Ultimately, costs are paid for by customers through bills and companies have asked for these to be increased by as much as 70 per cent by 2030.

An additional issue for investors is that rules introduced by Ofwat in March last year restrain dividend payouts if they put companies’ financial resilience at risk or if they underperform on social or environmental metrics.

The restrictions to dividends are an obstacle to investors, whose primary duty is to satisfy their shareholders, some of which are pension funds with thousands of retirees depending on the income.

The water companies tend to have corporate structures with multiple layers, many of which exist to raise finance. Ofwat only regulates the operating company and counts all payments out of that as dividends, even though investors argue that these are often used to service debt at the other entities rather than to directly enrich shareholders.

Leaver said: “In the absence of dividends, which are often used to service the debt at the holding companies, the financial companies will go bust pretty quickly.”

The FT’s research is based on data provided by Ofwat, inflated to 2023 prices using the financial year average CPIH.

The regulator does not adjust dividend figures for the 32-year period for inflation, giving it a nominal cumulative total for the period of £52bn.

The prospect that Thames Water may face temporary renationalisation has put the utilities in the public and political spotlight.

All 16 companies have been criticised for service failures, including tipping unknown quantities of sewage into waterways, high leakage rates or water outages. The Environment Agency is conducting its largest ever criminal investigation into potential widespread non-compliance by water and sewerage companies at more than 2,200 sewage treatment works, while Ofwat is also running its own investigation into the issue.

“The government needs someone to come in and be prepared to put some money in,” said one water company investor. “But it’s not an attractive environment at the moment . . . there’s every risk that you’ll lose your shirt.”

Also Read More: World News | Entertainment News | Celebrity News