A wealthy couple is currently involved in a legal dispute worth £1 million with an insurance company that has declined to compensate them for rebuilding expenses and high-end watches lost in a house fire.

Biborka Bellhouse, 42, a sought-after wedding makeup artist, and her husband Charles Bellhouse, 46, a property investment executive, saw their £2 million residence in Chiswick, west London, engulfed in flames in December 2022.

The luxurious four-bedroom home was severely impacted by the fire, which erupted while the couple was in the middle of renovating and expanding the property.

Home insurance company Zurich subsequently paid them around £16,000 for scaffolding to make the property safe, and £140,000 for alternative accommodation and furniture.

But the insurers refused to pay out £600,000 rebuilding costs and up to £475,000 contents cover – including for a £300,000 collection of valuable watches.

Only one of the watches was in the home at the time of the fire, but the couple claim boxes and authenticity certificates may have perished in the flames.

The couple are also claiming ‘medical expenses’ of around £8,000, stating they suffered ‘psychological harm’ and needed therapy due to Zurich’s failure to pay out.

Zurich insisted the family had breached the terms of their cover by having an extension built without telling them, invalidating the policy.

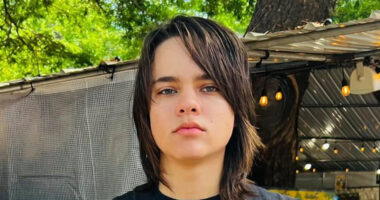

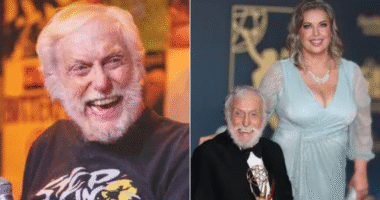

Biborka Bellhouse, 42, and her husband Charles Bellhouse, 46, are suing their home insurer after their £2million Chiswick property went up in flames in December 2022

Biborka and Charles Bellhouse’s home went up in flames on December 29, 2022, with 60 firefighters rushing to bring the blaze under control

The couple have claimed ‘medical expenses’ of around £8,000, stating they suffered ‘psychological harm’ and needed therapy due to Zurich’s failure to pay out

The four-bed detached house in Park Road, Chiswick, was seriously damaged in the blaze which broke out while they were in the process of having it extended and refurbished (Pictured left to right: Biborka and Charles Bellhouse)

Now the couple are suing Zurich Insurance Plc at the High Court in a bid to force them to pay out so they can reconstruct their destroyed home.

They also want around £20,000 for additional scaffolding costs and around £600,000 to rebuild the property, although they say the project may cost more.

Lawyers for Zurich say it is not obliged to pay out anything else on the policy and has ‘avoided liability’ due to a ‘misrepresentation’.

They say that when the couple took out the insurance, they had no plans to carry out any major works to their home within the next 12 months.

The company says it would not have insured the house had it known the extension and renovation was planned and as such the policy is invalid.

It took 60 firefighters and eight fire engines to bring the blaze under control. Neither the couple or their children were home when the incident occurred.

In documents submitted to the court, Mek Mesfin, representing the multi-millionaire couple, explained the fire broke out causing ‘substantial damage’ to their home.

‘Following the fire, a claim was made under the policy,’ said the barrister, who went to claim Zurich has ‘wrongfully and in breach of the terms of the policy’ refused to accept liability beyond scaffolding and rehousing payments.

Biborka and Chalres Bellhouse have sued Zurich Insurance for causing ‘psychological harm’ after they failed to pay out over fire that destroyed their £2m house

Biborka, also known as Bibi, is a luxury wedding makeup artist

‘[The insurance firm] has refused to pay the claimants any sum in respect of the losses which the claimants have suffered as a consequence of the fire.’

The Rolex Chronograph and the Patek were individually insured for £40,000 and £187,000 respectively, while three other Rolex watches were insured for £75,000.

According to the barrister, only one of the valuable watches was in the home at the time of the fire, however boxes and authenticity certificates may have perished in the flames, potentially impacting the value of the other luxury accessories.

‘The authentication materials, including the boxes and/or certification, for the watches were in the property during the fire. Due to the unsafe condition of the property, the claimants do not know, but assume, whether they have been damaged or destroyed,’ he said.

Mr Mesfin insisted his clients are entitled to indemnity and/or damages from the insurance firm if the items suffered a loss in value as a result of damage to authentication materials in the fire.

they went on to claim £16,000 towards scaffolding to make the property safe and around £140,000 for alternative accommodation and furniture from their insurers, Zurich

However the insurance firm has refused to pay out over £1,000,000 for rebuilding part of the property as well as some luxury watches

At a pre-trial hearing in the case, Judge David Hodge explained: ‘Zurich asserts that in May 2022, the claimants made a deliberate or reckless, or careless, qualifying misrepresentation by misrepresenting their intention to carry out contract works to their home in the following 12 months.

‘The claimants expressly confirmed…that the property was not likely to undergo any contract works within the next 12 months

‘The claimants did then, in fact, carry out the contract works; and these caused loss and damage, both to the contract works themselves, and to the property, on 29 December 2022, when a fire occurred during the course of the contract works.

‘Without the misrepresentation, Zurich would not have entered into the contract of insurance with the claimants at all. Zurich have now avoided the policy.’

However, he said the couple deny making a ‘qualifying misrepresentation’ and insist there is ‘no factual basis’ for the allegations made against them.

They are suing for a declaration that Zurich is obliged under the insurance policy to compensate them in respect of the claim, together with an indemnity, damages, interest and costs.

In its defence, Zurich barrister Daniel Crowley says that as well as denying they are liable to pay out anything else, the insurer is counterclaiming in a bid to force the family to pay back the £169,507 it has already paid out to them.

The couple and the insurers have already clashed in two preliminary hearings. The case will now return to court for a full trial unless it is settled beforehand.