Unlock the Editor’s Digest for free

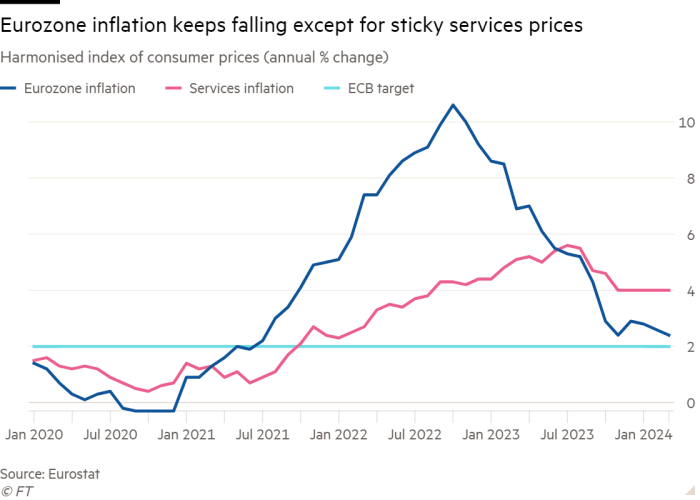

Eurozone inflation fell to 2.4 per cent in March, lower than forecast, bolstering expectations that the European Central Bank will cut interest rates by the summer.

The slowdown of annual consumer price growth from 2.6 per cent the previous month reflected smaller increases in food and goods prices, which offset steady services prices, according to data released by the EU statistics office Eurostat on Wednesday. Economists polled by Bloomberg had forecast a March reading of 2.5 per cent.

The easing of the region’s worst cost of living crisis for a generation will be welcomed by the ECB, which meets next week to discuss how soon to loosen monetary policy. Most analysts expect policymakers to wait until June to begin cutting rates.

Many rate-setters worry that rapid wage growth is still pushing up costs in the labour-intensive services sector, in which prices rose at a steady annual pace of 4 per cent for the fifth month in a row.

Diego Iscaro, economist at S&P Global Market Intelligence, said March’s fall in headline inflation “may raise expectations for a rate cut later this month”. But he predicted the “stickiness of services prices will make the ECB wait for further evidence of easing wage growth before starting the easing cycle” in June.

Some economists had predicted eurozone services inflation would rise in March owing to the earlier timing of Easter, which was expected to push up prices of package holidays and flights.

Core inflation, which strips out energy and food prices to give a better picture of underlying price pressures, fell slightly more than economists expected to 2.9 per cent in March, compared with 3.1 per cent in February.

Eurozone inflation has fallen rapidly from its peak of 10.6 per cent in October 2022, after the disruption of the coronavirus pandemic and Russia’s invasion of Ukraine triggered the biggest price surge for decades, to leave it tantalisingly close to the ECB’s 2 per cent target.

Senior ECB policymakers, however, have signalled they are likely to wait until June before deciding on potential rate cuts to give them more time to assess if wage pressures are moderating enough to keep inflation falling to their target.

Separate data released by Eurostat on Wednesday showed the eurozone labour market remained resilient. An unemployment rate of 6.5 per cent in February was unchanged from a slightly upwardly revised figure in January.

One worrying sign for rate-setters was that on a month-by-month basis, consumer prices in the single currency bloc rose 0.8 per cent in March, an acceleration from 0.6 per cent the previous month. The month-on-month core inflation rate rose to 1.1 per cent.

On an annual basis, eurozone fresh food prices fell for the first time in almost three years, dropping 0.4 per cent in March. Energy prices fell 1.8 per cent, a slower decline than the 3.7 per cent fall in February. Goods prices rose 1.1 per cent, the slowest pace since 2021.

Also Read More: World News | Entertainment News | Celebrity News