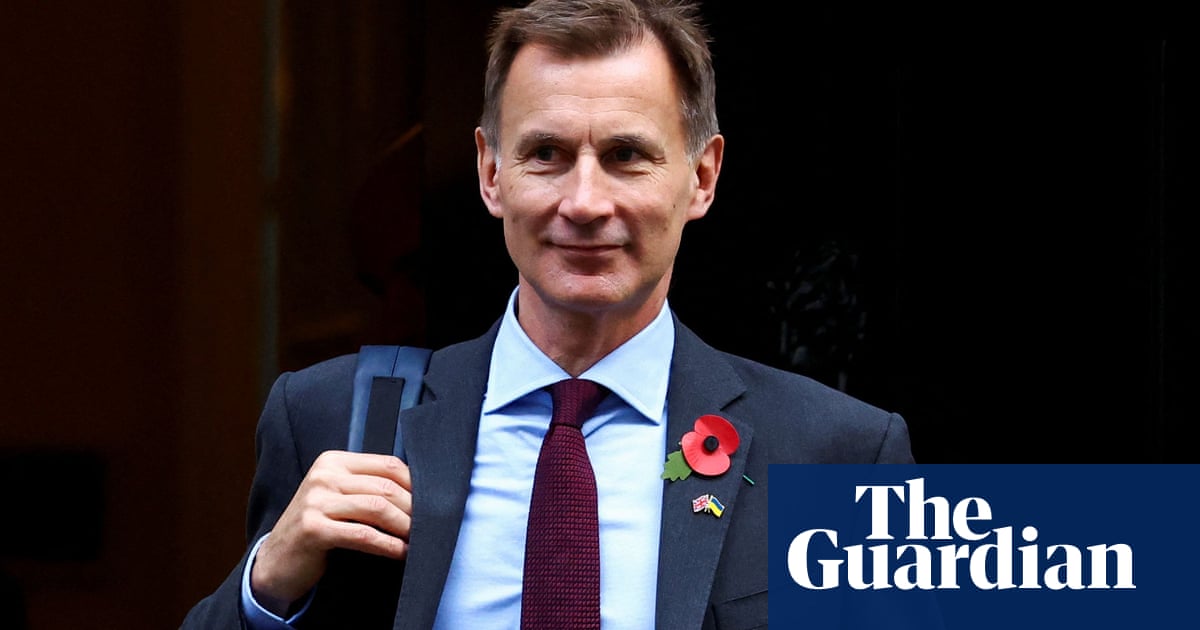

Jeremy Hunt will set out tax rises and spending cuts totalling £60bn at the autumn statement under current plans, including at least £35bn in cuts, the Guardian understands.

Ministers must submit the key points of the autumn statement to the Office for Budget Responsibility (OBR) by Monday morning.

Treasury sources also said that decisions on whether to raise benefits in line with inflation and whether to change the pensions triple lock were likely to be made within days so that the OBR could factor them into forecasts.

Tory MPs have already protested against previous suggestions of breaking the triple lock, which would raise pensions in line with inflation, and linking benefits to wages rather than inflation.

Early drafts of the statement contain plans for up to £35bn of spending cuts and up to £25bn of tax rises, which are likely to include freezing income tax thresholds and targeting dividend tax relief.

A Whitehall source said the figures remained estimates and subject to change but that Hunt, the chancellor, told an all-staff meeting he was looking for measures totalling at least £50bn-60bn .

The scale of the measures has been made greater by the Bank of England’s dire forecasts last week, when it predicted that higher interest rates would push the economy into the longest recession since the 1930s.

The Bank blamed higher energy prices and a tight labour market for the decision to increase interest rates. Hunt’s fiscal squeeze is likely to worsen the forecasts, and the Bank said the economy was already contracting and would continue to shrink for eight consecutive quarters to the summer of 2024.

The chancellor is said to be concerned with making sure the measures give the Treasury sufficient “headroom” for further economic shocks and ensuring the plans have market credibility. “Filling it to the pound isn’t credible,” one Treasury source said, in reference to the so-called fiscal “blackhole”.

Conservative MPs will probably be alarmed by reported plans for a raid on capital gains and pensions tax relief.

Targeting higher-rate pensions tax relief would hit those earning more than £50,270, who receive 40% tax relief on their pensions savings under the current system. Landlords, business owners and savers are also likely to be most affected by changes to capital gains rules, in what are likely to be a reduction in reliefs and allowances.

Capital gains has the potential to bring in billions if it were changed to match income tax rates. Such a change was the top recommendation of the Office of Tax Simplification in 2020, but it was rejected by Rishi Sunak last year when he was chancellor.

Hunt has previously said the guiding principle will be that “those with the broadest shoulders should be asked to bear the greatest burden”.

Sunak and Hunt are said to have agreed that tax thresholds will be frozen until 2028, two years later than previously announced. It would raise money from millions as inflation drags more people into higher tax brackets or into paying tax for the first time. It is predicted to raise £5bn a year, but has been labelled a “stealth tax”.

Read More: World News | Entertainment News | Celeb News

Guardian