UK interest rates expected to rise less sharply

In the City, investors are rethinking how high the Bank of England will need to raise interest rates, now that inflation has dropped by more than expected to a 15-month low of 7.9% in June.

The money markets now think there is a 65% chance that the Bank only raises rates by a quarter-point, from 5% to 5.25%, at its meeting in early August.

A larger, half-point, hike next month is seen as a 35% chance.

Last night, the odds were the other way around – with a half-point rise seen as a 58% chance (as flagged earlier).

Looking further ahead, UK interest rates are now seen peaking at around 5.8% in February 2024, down from around 6% yesterday.

Earlier this month, the markets had priced in rates rising as high as 6.5% by March.

Mohamed El-Erian, chief economic advisor to Allianz, says this is good news for mortgage holders.

The immediate reaction of the #markets to the better-than-expected #UK #Inflation includes a weaker #currency as markets are inclined to reprice lower the path of interest rates.

This is good news for those looking for mortgages and have faced higher costs and occasional… pic.twitter.com/SLzUXILzRP— Mohamed A. El-Erian (@elerianm) July 19, 2023

","url":"https://twitter.com/elerianm/status/1681552108271685635","id":"1681552108271685635","hasMedia":false,"role":"inline","isThirdPartyTracking":false,"source":"Twitter","elementId":"40fad233-23ce-4dc4-986d-03397665748e"}}”>

The immediate reaction of the #markets to the better-than-expected #UK #Inflation includes a weaker #currency as markets are inclined to reprice lower the path of interest rates.

This is good news for those looking for mortgages and have faced higher costs and occasional… pic.twitter.com/SLzUXILzRP— Mohamed A. El-Erian (@elerianm) July 19, 2023

Paul Dales, chief economist at Capital Economics, says:

Overall, the UK will probably still have higher rates of inflation than elsewhere for a while yet, but at least the UK is now following the global trend. Our forecast is that core and services CPI inflation will both ease gradually as the effects of the previous rises in interest rates are felt.

But with wage growth and services CPI inflation both currently stronger than the Bank had expected back in May, we think there is enough evidence of “more persistent pressures” to prompt the Bank to raise interest rates a little bit further than we previously thought.

Even so, we think rates are more likely to peak between 5% and 6% than between 6% and 7%.

<gu-island name="KeyEventsCarousel" deferuntil="visible" props="{"keyEvents":[{"id":"64b7840e8f08d284f1f0c811","elements":[{"_type":"model.dotcomrendering.pageElements.TextBlockElement","html":"

In the City, investors are rethinking how high the Bank of England will need to raise interest rates, now that inflation has dropped by more than expected to a 15-month low of 7.9% in June.

","elementId":"f7651885-9e2e-45e9-b4f1-bd4162a58c76"},{"_type":"model.dotcomrendering.pageElements.TextBlockElement","html":"

The money markets now think there is a 65% chance that the Bank only raises rates by a quarter-point, from 5% to 5.25%, at its meeting in early August.

","elementId":"664ac07b-31a3-4b28-a5d7-dd4e0454a397"},{"_type":"model.dotcomrendering.pageElements.TextBlockElement","html":"

A larger, half-point, hike next month is seen as a 35% chance.

","elementId":"0b99dd01-deab-4fd8-921a-758294aa79d1"},{"_type":"model.dotcomrendering.pageElements.TextBlockElement","html":"

Last night, the odds were the other way around – with a half-point rise seen as a 58% chance (as flagged earlier).

","elementId":"8eae905c-4fad-4816-bca2-44c3fa11c8ae"},{"_type":"model.dotcomrendering.pageElements.TextBlockElement","html":"

Looking further ahead, UK interest rates are now seen peaking at around 5.8% in February 2024, down from around 6% yesterday.

","elementId":"60235f67-36c8-428d-b0df-919fffceee4b"},{"_type":"model.dotcomrendering.pageElements.TextBlockElement","html":"

Earlier this month, the markets had priced in rates rising as high as 6.5% by March.

","elementId":"86c7b284-7fd4-4366-b8c3-ff4646ea759a"},{"_type":"model.dotcomrendering.pageElements.TextBlockElement","html":"

Mohamed El-Erian, chief economic advisor to Allianz, says this is good news for mortgage holders.

","elementId":"23db3316-8b65-4f48-8dcb-3c9618786126"},{"_type":"model.dotcomrendering.pageElements.TweetBlockElement","html":"

The immediate reaction of the #markets to the better-than-expected #UK #Inflation includes a weaker #currency as markets are inclined to reprice lower the path of interest rates.

This is good news for those looking for mortgages and have faced higher costs and occasional… pic.twitter.com/SLzUXILzRP— Mohamed A. El-Erian (@elerianm) July 19, 2023

","url":"https://twitter.com/elerianm/status/1681552108271685635","id":"1681552108271685635","hasMedia":false,"role":"inline","isThirdPartyTracking":false,"source":"Twitter","elementId":"c2d31a50-fedd-4b36-a10c-731c4624a08c"},{"_type":"model.dotcomrendering.pageElements.TextBlockElement","html":"

Paul Dales, chief economist at Capital Economics, says:

","elementId":"8442464e-05d9-4112-a8c6-5d93ca87f9f9"},{"_type":"model.dotcomrendering.pageElements.BlockquoteBlockElement","html":"

\n

Overall, the UK will probably still have higher rates of inflation than elsewhere for a while yet, but at least the UK is now following the global trend. Our forecast is that core and services CPI inflation will both ease gradually as the effects of the previous rises in interest rates are felt.

\n

But with wage growth and services CPI inflation both currently stronger than the Bank had expected back in May, we think there is enough evidence of “more persistent pressures” to prompt the Bank to raise interest rates a little bit further than we previously thought.

\n

Even so, we think rates are more likely to peak between 5% and 6% than between 6% and 7%.

\n

","elementId":"8be58547-328a-4acb-89c9-3e158e2cbb55"}],"attributes":{"pinned":true,"keyEvent":true,"summary":false},"blockCreatedOn":1689748494000,"blockCreatedOnDisplay":"07.34 BST","blockLastUpdated":1689748974000,"blockLastUpdatedDisplay":"07.42 BST","blockFirstPublished":1689748926000,"blockFirstPublishedDisplay":"07.42 BST","blockFirstPublishedDisplayNoTimezone":"07.42","title":"UK interest rates expected to rise less sharply","contributors":[],"primaryDateLine":"Wed 19 Jul 2023 07.56 BST","secondaryDateLine":"First published on Wed 19 Jul 2023 06.20 BST"},{"id":"64b783b38f0835a0b49534ee","elements":[{"_type":"model.dotcomrendering.pageElements.TextBlockElement","html":"

Shadow chancellor Rachel Reeves points out that an inflation rate of 7.9% still means prices are rising at ‘staggering rates’.

","elementId":"1b63f9df-25c9-4535-b747-81457f9e80e5"},{"_type":"model.dotcomrendering.pageElements.TextBlockElement","html":"

That’s an important point – falling inflation does not mean prices are falling (just that they are rising less rapidly).

","elementId":"c40c8ddf-293c-4f69-b76a-d6130c8a9640"},{"_type":"model.dotcomrendering.pageElements.TextBlockElement","html":"

Reeves says:

","elementId":"e23372cf-dd83-4c1b-beb5-ea7eef42054a"},{"_type":"model.dotcomrendering.pageElements.BlockquoteBlockElement","html":"

\n

“Inflation has been persistently high and remains higher than our international peers. This is becoming a hallmark of Tory economic failure.

\n

“Today’s numbers confirm what families across the country already know – that prices are still going up at staggering rates and that they’re bearing the brunt of those costs.

\n

“There may be global shocks – but Britain is so exposed to those because of Tory economic failure that has led to a severe lack of security in our economy.

\n

“Only Labour has the plans Britain needs to put our economy on a more secure path – so that families are better off and so we can grab hold of the opportunities of the future.”

\n

","elementId":"d16475ec-6cea-4017-9c9b-81319fc36f1d"}],"attributes":{"pinned":false,"keyEvent":true,"summary":false},"blockCreatedOn":1689748403000,"blockCreatedOnDisplay":"07.33 BST","blockLastUpdated":1689748490000,"blockLastUpdatedDisplay":"07.34 BST","blockFirstPublished":1689748490000,"blockFirstPublishedDisplay":"07.34 BST","blockFirstPublishedDisplayNoTimezone":"07.34","title":"Rachel Reeves: prices are still going up at staggering rates","contributors":[],"primaryDateLine":"Wed 19 Jul 2023 07.56 BST","secondaryDateLine":"First published on Wed 19 Jul 2023 06.20 BST"},{"id":"64b77f2f8f08d284f1f0c7ee","elements":[{"_type":"model.dotcomrendering.pageElements.TextBlockElement","html":"

Sterling has dropped sharply in the foreign exchange markets, as investors react to the drop in UK inflation in June to 7.9%.

","elementId":"efdcfd78-74f2-4b50-838a-b51254c4bd84"},{"_type":"model.dotcomrendering.pageElements.TextBlockElement","html":"

The pound has lost almost a cent against the US dollar to $1.2940, down from $1.3034 last night.

","elementId":"5d0f3eac-8edb-45a5-a1ca-7a39fc9e724e"},{"_type":"model.dotcomrendering.pageElements.TextBlockElement","html":"

That suggests the City are expecting that fewer increases in interest rates may be needed to cool UK inflation….

","elementId":"84bd0242-676b-4212-8bd0-5f11cefe0d18"},{"_type":"model.dotcomrendering.pageElements.TweetBlockElement","html":"

Pound down vs US dollar as traders react to the lower-than-expected inflation. Will be interesting to see what this does to interest rate expectations too. Full inflation release from @ONS here: https://t.co/J8rFd9LLQi pic.twitter.com/ceUl5llgFj

— Ed Conway (@EdConwaySky) July 19, 2023

","url":"https://twitter.com/EdConwaySky/status/1681546110689595392","id":"1681546110689595392","hasMedia":false,"role":"inline","isThirdPartyTracking":false,"source":"Twitter","elementId":"445d2355-0981-43a3-b8e7-fc7a90b6662d"}],"attributes":{"pinned":false,"keyEvent":true,"summary":false},"blockCreatedOn":1689747247000,"blockCreatedOnDisplay":"07.14 BST","blockLastUpdated":1689747877000,"blockLastUpdatedDisplay":"07.24 BST","blockFirstPublished":1689747411000,"blockFirstPublishedDisplay":"07.16 BST","blockFirstPublishedDisplayNoTimezone":"07.16","title":"Pound falls after inflation report","contributors":[],"primaryDateLine":"Wed 19 Jul 2023 07.56 BST","secondaryDateLine":"First published on Wed 19 Jul 2023 06.20 BST"},{"id":"64b77ea68f0835a0b49534c7","elements":[{"_type":"model.dotcomrendering.pageElements.TextBlockElement","html":"

Importantly, underlying inflation has dropped in June too.

","elementId":"d7e1af82-410e-445e-ada8-d26fbb2c5cf6"},{"_type":"model.dotcomrendering.pageElements.TextBlockElement","html":"

Core CPI, which excludes energy, food, alcohol and tobacco, rose by 6.9% in the 12 months to June 2023, down from 7.1% in May (which was a 30-year high).

","elementId":"cef0abb3-6b56-4ffb-9649-03677982ba05"},{"_type":"model.dotcomrendering.pageElements.TextBlockElement","html":"

Economists had expected core inflation would stick at 7.1%, so this could encourage the Bank of England that inflationary pressures are a little less sticky than feared.

","elementId":"494c7950-304e-41d3-ae64-d0141cbc0112"},{"_type":"model.dotcomrendering.pageElements.TextBlockElement","html":"

But, the Bank’s target is to bring headline CPI inflation down to 2%, so policymakers could still press on with interest rate rises in the month ahead…

","elementId":"b060c6dd-1432-410f-b501-bbb3daf108dc"},{"_type":"model.dotcomrendering.pageElements.TweetBlockElement","html":"

🇬🇧 UK June inflation rate lower than expected at 7.9%

Core inflation – a measure which excludes food, energy, alcohol and tobacco prices and which the BoE watches closely to gauge underlying price pressures – also dropped by more than expected, coming in at 6.9% from May's 7.1%,… pic.twitter.com/Oabspav74V

— PiQ (@PriapusIQ) July 19, 2023

","url":"https://twitter.com/PriapusIQ/status/1681547633876189185","id":"1681547633876189185","hasMedia":false,"role":"inline","isThirdPartyTracking":false,"source":"Twitter","elementId":"9f4f86a7-bc48-43fc-93ab-c56c0176e25f"}],"attributes":{"pinned":false,"keyEvent":true,"summary":false},"blockCreatedOn":1689747110000,"blockCreatedOnDisplay":"07.11 BST","blockLastUpdated":1689747328000,"blockLastUpdatedDisplay":"07.15 BST","blockFirstPublished":1689747245000,"blockFirstPublishedDisplay":"07.14 BST","blockFirstPublishedDisplayNoTimezone":"07.14","title":"Core UK inflation drops to 6.9%","contributors":[],"primaryDateLine":"Wed 19 Jul 2023 07.56 BST","secondaryDateLine":"First published on Wed 19 Jul 2023 06.20 BST"},{"id":"64b77e508f08ed3a541d2460","elements":[{"_type":"model.dotcomrendering.pageElements.TextBlockElement","html":"

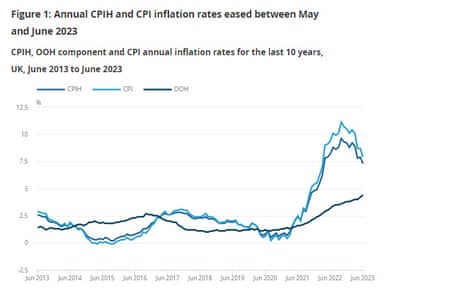

Here’s a chart showing how UK inflation has fallen to its lowest level since March 2022 (when it was 7%) last month, away from the peak of 11.1% hit in October last year.

","elementId":"aabf086f-fc20-4c0c-88d3-d11cdf2bef20"},{"_type":"model.dotcomrendering.pageElements.ImageBlockElement","media":{"allImages":[{"index":0,"fields":{"height":"421","width":"657"},"mediaType":"Image","mimeType":"image/jpeg","url":"https://media.guim.co.uk/b3b209eca659cec7e86a0f9c5800291db3a3c851/0_0_657_421/657.jpg"},{"index":1,"fields":{"isMaster":"true","height":"421","width":"657"},"mediaType":"Image","mimeType":"image/jpeg","url":"https://media.guim.co.uk/b3b209eca659cec7e86a0f9c5800291db3a3c851/0_0_657_421/master/657.jpg"},{"index":2,"fields":{"height":"320","width":"500"},"mediaType":"Image","mimeType":"image/jpeg","url":"https://media.guim.co.uk/b3b209eca659cec7e86a0f9c5800291db3a3c851/0_0_657_421/500.jpg"},{"index":3,"fields":{"height":"90","width":"140"},"mediaType":"Image","mimeType":"image/jpeg","url":"https://media.guim.co.uk/b3b209eca659cec7e86a0f9c5800291db3a3c851/0_0_657_421/140.jpg"}]},"data":{"alt":"A chart showing UK inflation","credit":"Photograph: ONS"},"displayCredit":true,"role":"inline","imageSources":[{"weighting":"inline","srcSet":[{"src":"https://i.guim.co.uk/img/media/b3b209eca659cec7e86a0f9c5800291db3a3c851/0_0_657_421/master/657.jpg?width=620&quality=85&auto=format&fit=max&s=31df3e850d973b96a1abf5a424a83d86","width":620},{"src":"https://i.guim.co.uk/img/media/b3b209eca659cec7e86a0f9c5800291db3a3c851/0_0_657_421/master/657.jpg?width=620&quality=45&auto=format&fit=max&dpr=2&s=f5b36bf8635dce12c17fa6023489615c","width":1240},{"src":"https://i.guim.co.uk/img/media/b3b209eca659cec7e86a0f9c5800291db3a3c851/0_0_657_421/master/657.jpg?width=605&quality=85&auto=format&fit=max&s=8c4284df5b492dec86216538c0f1e44b","width":605},{"src":"https://i.guim.co.uk/img/media/b3b209eca659cec7e86a0f9c5800291db3a3c851/0_0_657_421/master/657.jpg?width=605&quality=45&auto=format&fit=max&dpr=2&s=df77f624bb7d28cad2aabd03d0c21fe3","width":1210},{"src":"https://i.guim.co.uk/img/media/b3b209eca659cec7e86a0f9c5800291db3a3c851/0_0_657_421/master/657.jpg?width=445&quality=85&auto=format&fit=max&s=c31a3a3da06c970180e7999bdb701f24","width":445},{"src":"https://i.guim.co.uk/img/media/b3b209eca659cec7e86a0f9c5800291db3a3c851/0_0_657_421/master/657.jpg?width=445&quality=45&auto=format&fit=max&dpr=2&s=5ad30925b1310ebadd77668a665baa43","width":890}]},{"weighting":"thumbnail","srcSet":[{"src":"https://i.guim.co.uk/img/media/b3b209eca659cec7e86a0f9c5800291db3a3c851/0_0_657_421/master/657.jpg?width=140&quality=85&auto=format&fit=max&s=a630769b97dbbe86f598c6624f45db23","width":140},{"src":"https://i.guim.co.uk/img/media/b3b209eca659cec7e86a0f9c5800291db3a3c851/0_0_657_421/master/657.jpg?width=140&quality=45&auto=format&fit=max&dpr=2&s=2316dbb1c23ce58fe71749a65548cb65","width":280},{"src":"https://i.guim.co.uk/img/media/b3b209eca659cec7e86a0f9c5800291db3a3c851/0_0_657_421/master/657.jpg?width=120&quality=85&auto=format&fit=max&s=998fb930d0012856ef718090b161bf3a","width":120},{"src":"https://i.guim.co.uk/img/media/b3b209eca659cec7e86a0f9c5800291db3a3c851/0_0_657_421/master/657.jpg?width=120&quality=45&auto=format&fit=max&dpr=2&s=5bcf6e23350dfadb6668703944622723","width":240}]},{"weighting":"supporting","srcSet":[{"src":"https://i.guim.co.uk/img/media/b3b209eca659cec7e86a0f9c5800291db3a3c851/0_0_657_421/master/657.jpg?width=380&quality=85&auto=format&fit=max&s=d66122a6a1680b2f92ee532dd59fe8e9","width":380},{"src":"https://i.guim.co.uk/img/media/b3b209eca659cec7e86a0f9c5800291db3a3c851/0_0_657_421/master/657.jpg?width=380&quality=45&auto=format&fit=max&dpr=2&s=22eead6626f7ab7979275c0c5eaf55eb","width":760},{"src":"https://i.guim.co.uk/img/media/b3b209eca659cec7e86a0f9c5800291db3a3c851/0_0_657_421/master/657.jpg?width=300&quality=85&auto=format&fit=max&s=a38c18fc423b40749ab270c581e04597","width":300},{"src":"https://i.guim.co.uk/img/media/b3b209eca659cec7e86a0f9c5800291db3a3c851/0_0_657_421/master/657.jpg?width=300&quality=45&auto=format&fit=max&dpr=2&s=ccc374b5979b9e6075ff9c04ec61bb70","width":600},{"src":"https://i.guim.co.uk/img/media/b3b209eca659cec7e86a0f9c5800291db3a3c851/0_0_657_421/master/657.jpg?width=620&quality=85&auto=format&fit=max&s=31df3e850d973b96a1abf5a424a83d86","width":620},{"src":"https://i.guim.co.uk/img/media/b3b209eca659cec7e86a0f9c5800291db3a3c851/0_0_657_421/master/657.jpg?width=620&quality=45&auto=format&fit=max&dpr=2&s=f5b36bf8635dce12c17fa6023489615c","width":1240},{"src":"https://i.guim.co.uk/img/media/b3b209eca659cec7e86a0f9c5800291db3a3c851/0_0_657_421/master/657.jpg?width=605&quality=85&auto=format&fit=max&s=8c4284df5b492dec86216538c0f1e44b","width":605},{"src":"https://i.guim.co.uk/img/media/b3b209eca659cec7e86a0f9c5800291db3a3c851/0_0_657_421/master/657.jpg?width=605&quality=45&auto=format&fit=max&dpr=2&s=df77f624bb7d28cad2aabd03d0c21fe3","width":1210},{"src":"https://i.guim.co.uk/img/media/b3b209eca659cec7e86a0f9c5800291db3a3c851/0_0_657_421/master/657.jpg?width=445&quality=85&auto=format&fit=max&s=c31a3a3da06c970180e7999bdb701f24","width":445},{"src":"https://i.guim.co.uk/img/media/b3b209eca659cec7e86a0f9c5800291db3a3c851/0_0_657_421/master/657.jpg?width=445&quality=45&auto=format&fit=max&dpr=2&s=5ad30925b1310ebadd77668a665baa43","width":890}]},{"weighting":"showcase","srcSet":[{"src":"https://i.guim.co.uk/img/media/b3b209eca659cec7e86a0f9c5800291db3a3c851/0_0_657_421/master/657.jpg?width=860&quality=85&auto=format&fit=max&s=4d7ffb0d0bfa17ff5d5d03dc677dd478","width":860},{"src":"https://i.guim.co.uk/img/media/b3b209eca659cec7e86a0f9c5800291db3a3c851/0_0_657_421/master/657.jpg?width=860&quality=45&auto=format&fit=max&dpr=2&s=ea23dcee42297bddd9b5677fcdd39882","width":1720},{"src":"https://i.guim.co.uk/img/media/b3b209eca659cec7e86a0f9c5800291db3a3c851/0_0_657_421/master/657.jpg?width=780&quality=85&auto=format&fit=max&s=b442dcd98ed2c75ef5c9e8adc5a4bd1b","width":780},{"src":"https://i.guim.co.uk/img/media/b3b209eca659cec7e86a0f9c5800291db3a3c851/0_0_657_421/master/657.jpg?width=780&quality=45&auto=format&fit=max&dpr=2&s=7b9b632e13835be97b43863cb24be31e","width":1560},{"src":"https://i.guim.co.uk/img/media/b3b209eca659cec7e86a0f9c5800291db3a3c851/0_0_657_421/master/657.jpg?width=620&quality=85&auto=format&fit=max&s=31df3e850d973b96a1abf5a424a83d86","width":620},{"src":"https://i.guim.co.uk/img/media/b3b209eca659cec7e86a0f9c5800291db3a3c851/0_0_657_421/master/657.jpg?width=620&quality=45&auto=format&fit=max&dpr=2&s=f5b36bf8635dce12c17fa6023489615c","width":1240},{"src":"https://i.guim.co.uk/img/media/b3b209eca659cec7e86a0f9c5800291db3a3c851/0_0_657_421/master/657.jpg?width=605&quality=85&auto=format&fit=max&s=8c4284df5b492dec86216538c0f1e44b","width":605},{"src":"https://i.guim.co.uk/img/media/b3b209eca659cec7e86a0f9c5800291db3a3c851/0_0_657_421/master/657.jpg?width=605&quality=45&auto=format&fit=max&dpr=2&s=df77f624bb7d28cad2aabd03d0c21fe3","width":1210},{"src":"https://i.guim.co.uk/img/media/b3b209eca659cec7e86a0f9c5800291db3a3c851/0_0_657_421/master/657.jpg?width=445&quality=85&auto=format&fit=max&s=c31a3a3da06c970180e7999bdb701f24","width":445},{"src":"https://i.guim.co.uk/img/media/b3b209eca659cec7e86a0f9c5800291db3a3c851/0_0_657_421/master/657.jpg?width=445&quality=45&auto=format&fit=max&dpr=2&s=5ad30925b1310ebadd77668a665baa43","width":890}]},{"weighting":"halfwidth","srcSet":[{"src":"https://i.guim.co.uk/img/media/b3b209eca659cec7e86a0f9c5800291db3a3c851/0_0_657_421/master/657.jpg?width=620&quality=85&auto=format&fit=max&s=31df3e850d973b96a1abf5a424a83d86","width":620},{"src":"https://i.guim.co.uk/img/media/b3b209eca659cec7e86a0f9c5800291db3a3c851/0_0_657_421/master/657.jpg?width=620&quality=45&auto=format&fit=max&dpr=2&s=f5b36bf8635dce12c17fa6023489615c","width":1240},{"src":"https://i.guim.co.uk/img/media/b3b209eca659cec7e86a0f9c5800291db3a3c851/0_0_657_421/master/657.jpg?width=605&quality=85&auto=format&fit=max&s=8c4284df5b492dec86216538c0f1e44b","width":605},{"src":"https://i.guim.co.uk/img/media/b3b209eca659cec7e86a0f9c5800291db3a3c851/0_0_657_421/master/657.jpg?width=605&quality=45&auto=format&fit=max&dpr=2&s=df77f624bb7d28cad2aabd03d0c21fe3","width":1210},{"src":"https://i.guim.co.uk/img/media/b3b209eca659cec7e86a0f9c5800291db3a3c851/0_0_657_421/master/657.jpg?width=445&quality=85&auto=format&fit=max&s=c31a3a3da06c970180e7999bdb701f24","width":445},{"src":"https://i.guim.co.uk/img/media/b3b209eca659cec7e86a0f9c5800291db3a3c851/0_0_657_421/master/657.jpg?width=445&quality=45&auto=format&fit=max&dpr=2&s=5ad30925b1310ebadd77668a665baa43","width":890}]},{"weighting":"immersive","srcSet":[{"src":"https://i.guim.co.uk/img/media/b3b209eca659cec7e86a0f9c5800291db3a3c851/0_0_657_421/master/657.jpg?width=1900&quality=85&auto=format&fit=max&s=32f92218631c91f2e2e45f0360b21797","width":1900},{"src":"https://i.guim.co.uk/img/media/b3b209eca659cec7e86a0f9c5800291db3a3c851/0_0_657_421/master/657.jpg?width=1900&quality=45&auto=format&fit=max&dpr=2&s=b6f45f07c97b1d58b31814a246d5acaf","width":3800},{"src":"https://i.guim.co.uk/img/media/b3b209eca659cec7e86a0f9c5800291db3a3c851/0_0_657_421/master/657.jpg?width=1300&quality=85&auto=format&fit=max&s=0fddbf8dd78513c05f5c4ed5c8ccefb8","width":1300},{"src":"https://i.guim.co.uk/img/media/b3b209eca659cec7e86a0f9c5800291db3a3c851/0_0_657_421/master/657.jpg?width=1300&quality=45&auto=format&fit=max&dpr=2&s=5d3e57bdaee43c0c9d56930b438c2088","width":2600},{"src":"https://i.guim.co.uk/img/media/b3b209eca659cec7e86a0f9c5800291db3a3c851/0_0_657_421/master/657.jpg?width=1140&quality=85&auto=format&fit=max&s=9f3b1d771b48b3f099ebabd688d2fcf4","width":1140},{"src":"https://i.guim.co.uk/img/media/b3b209eca659cec7e86a0f9c5800291db3a3c851/0_0_657_421/master/657.jpg?width=1140&quality=45&auto=format&fit=max&dpr=2&s=8f0e085bb94ecfc448e5adcd7f163680","width":2280},{"src":"https://i.guim.co.uk/img/media/b3b209eca659cec7e86a0f9c5800291db3a3c851/0_0_657_421/master/657.jpg?width=980&quality=85&auto=format&fit=max&s=c2576693111b5090e7ec1991dd909b4b","width":980},{"src":"https://i.guim.co.uk/img/media/b3b209eca659cec7e86a0f9c5800291db3a3c851/0_0_657_421/master/657.jpg?width=980&quality=45&auto=format&fit=max&dpr=2&s=64b9054af2c7dff1a26949c34586fb3a","width":1960},{"src":"https://i.guim.co.uk/img/media/b3b209eca659cec7e86a0f9c5800291db3a3c851/0_0_657_421/master/657.jpg?width=740&quality=85&auto=format&fit=max&s=8fb678c66ff585d9c3cec401a73697b6","width":740},{"src":"https://i.guim.co.uk/img/media/b3b209eca659cec7e86a0f9c5800291db3a3c851/0_0_657_421/master/657.jpg?width=740&quality=45&auto=format&fit=max&dpr=2&s=cacf4892644be16fdb1950effe715679","width":1480},{"src":"https://i.guim.co.uk/img/media/b3b209eca659cec7e86a0f9c5800291db3a3c851/0_0_657_421/master/657.jpg?width=660&quality=85&auto=format&fit=max&s=27273845fa70b438e26ef076db575357","width":660},{"src":"https://i.guim.co.uk/img/media/b3b209eca659cec7e86a0f9c5800291db3a3c851/0_0_657_421/master/657.jpg?width=660&quality=45&auto=format&fit=max&dpr=2&s=d4de9309772f849ddc3a3cace6f82554","width":1320},{"src":"https://i.guim.co.uk/img/media/b3b209eca659cec7e86a0f9c5800291db3a3c851/0_0_657_421/master/657.jpg?width=480&quality=85&auto=format&fit=max&s=2e1e2086c489b06bd18d7a5d4211da44","width":480},{"src":"https://i.guim.co.uk/img/media/b3b209eca659cec7e86a0f9c5800291db3a3c851/0_0_657_421/master/657.jpg?width=480&quality=45&auto=format&fit=max&dpr=2&s=d800eee36ce74f31bf6f26be9d3dd1a5","width":960}]}],"elementId":"f7180f4e-d88a-4160-bdee-28606c0f16dd"}],"attributes":{"pinned":false,"keyEvent":true,"summary":false},"blockCreatedOn":1689747024000,"blockCreatedOnDisplay":"07.10 BST","blockLastUpdated":1689747088000,"blockLastUpdatedDisplay":"07.11 BST","blockFirstPublished":1689747088000,"blockFirstPublishedDisplay":"07.11 BST","blockFirstPublishedDisplayNoTimezone":"07.11","title":"UK inflation: the key chart","contributors":[],"primaryDateLine":"Wed 19 Jul 2023 07.56 BST","secondaryDateLine":"First published on Wed 19 Jul 2023 06.20 BST"},{"id":"64b77d2f8f0835a0b49534c2","elements":[{"_type":"model.dotcomrendering.pageElements.TextBlockElement","html":"

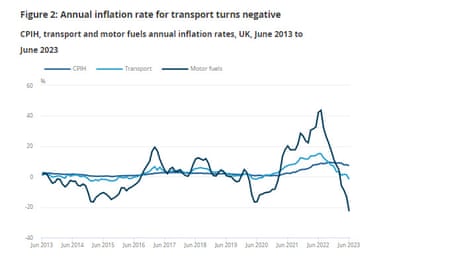

Falling prices for motor fuel helped to push the UK inflation rate down in June, the ONS says.

","elementId":"62164f26-c34d-4b14-9f63-6ab8b971b325"},{"_type":"model.dotcomrendering.pageElements.TextBlockElement","html":"

Food prices rose in June 2023 but by less than in June 2022, also leading to an easing in inflation.

","elementId":"82b63cc9-d4e2-4f1a-8d04-944898f051a7"},{"_type":"model.dotcomrendering.pageElements.TextBlockElement","html":"

Office for National Statistics (ONS) chief economist Grant Fitzner says:

","elementId":"89e17d38-40c3-4a96-a8a7-29c78f1e4f27"},{"_type":"model.dotcomrendering.pageElements.BlockquoteBlockElement","html":"

\n

“Inflation slowed substantially to its lowest annual rate since March 2022, driven by price drops for motor fuels. Meanwhile, core inflation also fell back after hitting a 30-year high in May.

\n

“Food price inflation eased slightly this month, although it remains at very high levels.

\n

“Although costs facing manufacturers remain elevated, especially for construction materials and food items, the pace of growth has fallen across the last year, with the overall cost of raw materials falling for the first time since late 2020.”

\n

","elementId":"a4bc298d-9066-42bc-9b36-b2c1dfdf3db5"},{"_type":"model.dotcomrendering.pageElements.TweetBlockElement","html":"

@GrantFitzner continued: (2/3) 💬 pic.twitter.com/IigwlIP91w

— Office for National Statistics (ONS) (@ONS) July 19, 2023

","url":"https://twitter.com/ONS/status/1681545452951420929","id":"1681545452951420929","hasMedia":false,"role":"inline","isThirdPartyTracking":false,"source":"Twitter","elementId":"a0a54ae6-828a-42da-a856-f5013baef64c"}],"attributes":{"pinned":false,"keyEvent":true,"summary":false},"blockCreatedOn":1689746735000,"blockCreatedOnDisplay":"07.05 BST","blockLastUpdated":1689748283000,"blockLastUpdatedDisplay":"07.31 BST","blockFirstPublished":1689746930000,"blockFirstPublishedDisplay":"07.08 BST","blockFirstPublishedDisplayNoTimezone":"07.08","title":"ONS: Food price inflation eased slightly","contributors":[],"primaryDateLine":"Wed 19 Jul 2023 07.56 BST","secondaryDateLine":"First published on Wed 19 Jul 2023 06.20 BST"},{"id":"64b779508f08ed3a541d243c","elements":[{"_type":"model.dotcomrendering.pageElements.TextBlockElement","html":"

Newsflash: UK inflation has fallen to a 15-month low, but still remains at painfully high levels.

","elementId":"5f440b6a-6e26-4436-9076-c9d7349cb662"},{"_type":"model.dotcomrendering.pageElements.TextBlockElement","html":"

The consumer price index rose by 7.9% in the year to June, new figures from the Office for National Statistics show, down from 8.7% in May.

","elementId":"d6ba772b-9f71-4f19-8c39-94c7ae886bb1"},{"_type":"model.dotcomrendering.pageElements.TextBlockElement","html":"

That’s the lowest reading since March 2022.

","elementId":"8c81f8c4-7c16-4dd7-be1c-b97db92bca63"},{"_type":"model.dotcomrendering.pageElements.TweetBlockElement","html":"

Annual inflation slowed in June 2023.

▪️ Consumer Prices Index including owner occupiers’ housing costs (CPIH) rose by 7.3% in the 12 months to June 2023, down from 7.9% in May

▪️ Consumer Prices Index (CPI) rose by 7.9%, down from 8.7% in May➡️ https://t.co/cPUYOHcBiw pic.twitter.com/hDD1Q2AiJb

— Office for National Statistics (ONS) (@ONS) July 19, 2023

","url":"https://twitter.com/ONS/status/1681544403284811776","id":"1681544403284811776","hasMedia":false,"role":"inline","isThirdPartyTracking":false,"source":"Twitter","elementId":"5c85a5c3-147f-4b18-854e-c2197e4d3a94"},{"_type":"model.dotcomrendering.pageElements.TextBlockElement","html":"

It’s a larger fall than expected, with City economists having predicted a fall to 8.2%, which will cheer policymakers at the Bank of England.

","elementId":"9565da7b-0699-4a60-95d7-e3fa4dccb7a2"}],"attributes":{"pinned":false,"keyEvent":true,"summary":false},"blockCreatedOn":1689745744000,"blockCreatedOnDisplay":"06.49 BST","blockLastUpdated":1689748048000,"blockLastUpdatedDisplay":"07.27 BST","blockFirstPublished":1689746571000,"blockFirstPublishedDisplay":"07.02 BST","blockFirstPublishedDisplayNoTimezone":"07.02","title":"UK inflation falls faster than expected in June","contributors":[],"primaryDateLine":"Wed 19 Jul 2023 07.56 BST","secondaryDateLine":"First published on Wed 19 Jul 2023 06.20 BST"},{"id":"64b69b508f08ed3a541d1cf7","elements":[{"_type":"model.dotcomrendering.pageElements.TextBlockElement","html":"

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

","elementId":"20ac1f1e-c71f-4252-903f-cb8bf7ec9159"},{"_type":"model.dotcomrendering.pageElements.TextBlockElement","html":"

Tension is high in the City, and in Westminster, this morning as we await the latest UK inflation report, due at 7am.

","elementId":"37795df1-e5c4-4ed7-81af-0d212a87354b"},{"_type":"model.dotcomrendering.pageElements.TextBlockElement","html":"

June’s CPI report is expected to show that price rises slowed last month. Economists predict that the annual inflation forecast will dip to 8.2% from 8.7% in both April and May.

","elementId":"cfc398d7-0d7c-45c4-b681-25e11cc12641"},{"_type":"model.dotcomrendering.pageElements.TextBlockElement","html":"

That would be the lowest reading in 15 months, since March 2022.

","elementId":"d395faea-2f79-4d77-bfc6-ba5bf353da61"},{"_type":"model.dotcomrendering.pageElements.InteractiveBlockElement","url":"https://interactive.guim.co.uk/charts/embed/jun/2023-06-21-07:08:25/embed.html","alt":"A chart showing UK inflation up to May 2023","scriptUrl":"https://interactive.guim.co.uk/embed/iframe-wrapper/0.1/boot.js","isMandatory":false,"elementId":"e561510f-289e-4c05-b989-d1d259ed9907"},{"_type":"model.dotcomrendering.pageElements.TextBlockElement","html":"

City economists predict that food and fuel provide the drag on inflation last month, as we catch up with the sharp price rises in summer 2022.

","elementId":"1d3537b9-a70c-4a0c-b7e9-084832fb85c9"},{"_type":"model.dotcomrendering.pageElements.RichLinkBlockElement","url":"https://www.theguardian.com/business/2023/jul/16/june-drop-in-uk-inflation-expected-but-heat-still-on-bank-of-england","text":"June drop in UK inflation expected but heat still on Bank of England","prefix":"Related: ","role":"thumbnail","elementId":"85392864-2dfc-4946-9c3b-f959197f48f2"},{"_type":"model.dotcomrendering.pageElements.TextBlockElement","html":"

Yesterday, data from Kantar showed that grocery price growth cooled to 14.9% per year in over the four weeks to 9 July.

","elementId":"9acc4c30-6430-4d5e-9ef8-695c0db4e726"},{"_type":"model.dotcomrendering.pageElements.TextBlockElement","html":"

But while a fall in inflation would be welcome, prices have been rising much faster than the Bank of England’s 2% inflation target for around two years.

","elementId":"d1046579-3330-4a1d-a4fc-137c8de290ee"},{"_type":"model.dotcomrendering.pageElements.TextBlockElement","html":"

Traders will also be watching for the latest core inflation reading, which is expected to remain at a 31-year high of 7.1%. That would maintain the pressure on the Bank of England to keep raising interest rates this year.

","elementId":"8a5751ba-a81a-42be-be91-99da38f6be50"},{"_type":"model.dotcomrendering.pageElements.TweetBlockElement","html":"

British households and businesses are bracing for UK inflation figures on Wednesday that are expected to keep the pressure on the Bank of England to raise interest rates again https://t.co/176c5GYp2u pic.twitter.com/jRk6MwcJHN

— Bloomberg UK (@BloombergUK) July 18, 2023

","url":"https://twitter.com/BloombergUK/status/1681282007697969152","id":"1681282007697969152","hasMedia":false,"role":"inline","isThirdPartyTracking":false,"source":"Twitter","elementId":"134c915b-3ffe-456b-87ed-c18fc2b69146"},{"_type":"model.dotcomrendering.pageElements.TextBlockElement","html":"

On Monday, prime minister Rishi Sunak acknowledged that inflation is not coming down as quickly as he would like (as his target to halve it by the end of the year, to around 5%, looks more challenging).

","elementId":"c2494783-71ac-4861-835f-0f988ccf1c95"},{"_type":"model.dotcomrendering.pageElements.TextBlockElement","html":"

Sunak told LBC:

","elementId":"f036b68b-151c-47ac-a0a7-3ef001e0bfb7"},{"_type":"model.dotcomrendering.pageElements.BlockquoteBlockElement","html":"

\n

“Inflation is prices going up, and they are all going up faster than we would like.

\n

“That’s what is eating into people’s pay packets, it’s what’s eroding their savings, it’s what’s putting up interest rates and putting pressure on mortgages.

\n

“So, the best way to help people with the cost of living … is to bring down inflation.

\n

","elementId":"ec4f6954-70bf-4705-93f3-a33ce97921e4"},{"_type":"model.dotcomrendering.pageElements.TextBlockElement","html":"

We’re about to find out how much progress has been made….

","elementId":"4555e0ad-db72-4502-a2f9-15e7010b6cc2"},{"_type":"model.dotcomrendering.pageElements.SubheadingBlockElement","html":"

Also coming up today

","elementId":"235b19b0-8e5e-473d-8a2a-d94b6b392a57"},{"_type":"model.dotcomrendering.pageElements.TextBlockElement","html":"

Jaguar Land Rover-owner Tata is expected to announce it will build its flagship electric car battery factory in the UK, in a major boost for the British car industry.

","elementId":"821d50b4-650a-4683-ac21-df08ce8a2fe4"},{"_type":"model.dotcomrendering.pageElements.TextBlockElement","html":"

The new plant in Somerset is likely to be officially announced on Wednesday, backed with £500m in government funding,

","elementId":"2ca00b2d-76b6-479c-a91b-28a8f2f367fa"},{"_type":"model.dotcomrendering.pageElements.RichLinkBlockElement","url":"https://www.theguardian.com/business/2023/jul/18/owner-of-jaguar-land-rover-to-announce-somerset-battery-gigafactory","text":"Jaguar Land Rover owner expected to announce Somerset battery gigafactory","prefix":"Related: ","role":"thumbnail","elementId":"b6fdd626-304c-4a0a-9df8-8f657045f3fb"},{"_type":"model.dotcomrendering.pageElements.SubheadingBlockElement","html":"

The agenda

","elementId":"8a091cf6-253e-4bcb-995a-c04ca704a548"},{"_type":"model.dotcomrendering.pageElements.TextBlockElement","html":"

- \n

-

7am BST: UK inflation report for June

-

9.30am BST: UK house price index for May

-

10am BST: Final estimate of eurozone inflation in June

-

1.30pm BST: US building permits for June

-

2.15pm BST: Treasury Committee to question Financial Conduct Authority on topics including mortgages and savings

-

4pm BST: Business and Trade committee hearing on the road fuel market with the CMA and Mohsin Issa CBE, co-owner of Asda.

\n

\n

\n

\n

\n

\n

","elementId":"7f9c1199-5062-4e5b-a525-9a6538853e7e"}],"attributes":{"pinned":false,"keyEvent":true,"summary":false},"blockCreatedOn":1689744001000,"blockCreatedOnDisplay":"06.20 BST","blockLastUpdated":1689748192000,"blockLastUpdatedDisplay":"07.29 BST","blockFirstPublished":1689744001000,"blockFirstPublishedDisplay":"06.20 BST","blockFirstPublishedDisplayNoTimezone":"06.20","title":"Introduction: All eyes on June’s UK inflation report","contributors":[],"primaryDateLine":"Wed 19 Jul 2023 07.56 BST","secondaryDateLine":"First published on Wed 19 Jul 2023 06.20 BST"}],"filterKeyEvents":false,"format":{"display":0,"theme":0,"design":11},"id":"key-events-carousel-mobile"}”>

Key events

Filters BETA

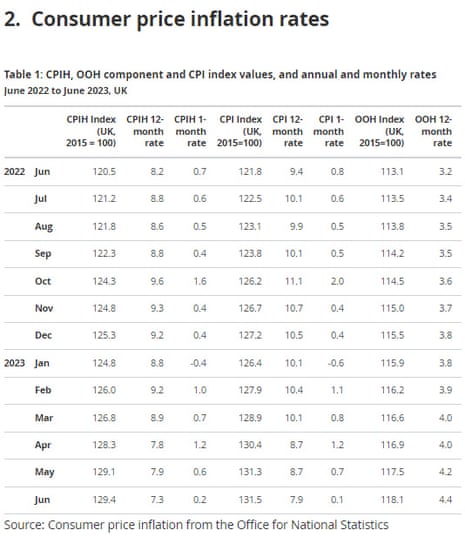

On a monthly basis, consumer prices rose by 0.1% in June.

That’s a slowdown on May, when prices rose by 0.7% month-on month.

Consumer prices have been rising on a monthly basis since February this year, as this table shows, which has kept the annual rate of inflation (prices compared to a year ago) high:

UK interest rates expected to rise less sharply

In the City, investors are rethinking how high the Bank of England will need to raise interest rates, now that inflation has dropped by more than expected to a 15-month low of 7.9% in June.

The money markets now think there is a 65% chance that the Bank only raises rates by a quarter-point, from 5% to 5.25%, at its meeting in early August.

A larger, half-point, hike next month is seen as a 35% chance.

Last night, the odds were the other way around – with a half-point rise seen as a 58% chance (as flagged earlier).

Looking further ahead, UK interest rates are now seen peaking at around 5.8% in February 2024, down from around 6% yesterday.

Earlier this month, the markets had priced in rates rising as high as 6.5% by March.

Mohamed El-Erian, chief economic advisor to Allianz, says this is good news for mortgage holders.

The immediate reaction of the #markets to the better-than-expected #UK #Inflation includes a weaker #currency as markets are inclined to reprice lower the path of interest rates.

This is good news for those looking for mortgages and have faced higher costs and occasional… pic.twitter.com/SLzUXILzRP— Mohamed A. El-Erian (@elerianm) July 19, 2023

","url":"https://twitter.com/elerianm/status/1681552108271685635","id":"1681552108271685635","hasMedia":false,"role":"inline","isThirdPartyTracking":false,"source":"Twitter","elementId":"fb048938-9ae0-4f53-9c0b-6a8a9c16ddf8"}}”>

The immediate reaction of the #markets to the better-than-expected #UK #Inflation includes a weaker #currency as markets are inclined to reprice lower the path of interest rates.

This is good news for those looking for mortgages and have faced higher costs and occasional… pic.twitter.com/SLzUXILzRP— Mohamed A. El-Erian (@elerianm) July 19, 2023

Paul Dales, chief economist at Capital Economics, says:

Overall, the UK will probably still have higher rates of inflation than elsewhere for a while yet, but at least the UK is now following the global trend. Our forecast is that core and services CPI inflation will both ease gradually as the effects of the previous rises in interest rates are felt.

But with wage growth and services CPI inflation both currently stronger than the Bank had expected back in May, we think there is enough evidence of “more persistent pressures” to prompt the Bank to raise interest rates a little bit further than we previously thought.

Even so, we think rates are more likely to peak between 5% and 6% than between 6% and 7%.

Rachel Reeves: prices are still going up at staggering rates

Shadow chancellor Rachel Reeves points out that an inflation rate of 7.9% still means prices are rising at ‘staggering rates’.

That’s an important point – falling inflation does not mean prices are falling (just that they are rising less rapidly).

Reeves says:

“Inflation has been persistently high and remains higher than our international peers. This is becoming a hallmark of Tory economic failure.

“Today’s numbers confirm what families across the country already know – that prices are still going up at staggering rates and that they’re bearing the brunt of those costs.

“There may be global shocks – but Britain is so exposed to those because of Tory economic failure that has led to a severe lack of security in our economy.

“Only Labour has the plans Britain needs to put our economy on a more secure path – so that families are better off and so we can grab hold of the opportunities of the future.”

Jeremy Hunt has said the government was not complacent about inflation, after it dropped to a 15-month low of 7.9% in June.

The chancellor says:

“Inflation is falling and stands at its lowest level since last March; but we aren’t complacent.”

Cheaper petrol and diesel at the pumps helped to pull inflation down last month.

Today’s inflation report shows that motor fuel prices fell by 22.7% in the year to June 2023, compared with a fall of 13.1% in May.

The ONS explains:

-

Average petrol and diesel prices stood at 143.0 and 145.7p per litre respectively in June 2023, compared with 184.0p and 192.4p per litre in June 2022.

-

Petrol prices fell by 1.4p per litre between May and June 2023, compared with a rise of 18.1p per litre between the same two months a year ago

-

Similarly, diesel prices fell by 8.9p per litre this year, compared with a rise of 12.7p per litre a year ago.

Pound falls after inflation report

Sterling has dropped sharply in the foreign exchange markets, as investors react to the drop in UK inflation in June to 7.9%.

The pound has lost almost a cent against the US dollar to $1.2940, down from $1.3034 last night.

That suggests the City are expecting that fewer increases in interest rates may be needed to cool UK inflation….

Pound down vs US dollar as traders react to the lower-than-expected inflation. Will be interesting to see what this does to interest rate expectations too. Full inflation release from @ONS here: https://t.co/J8rFd9LLQi pic.twitter.com/ceUl5llgFj

— Ed Conway (@EdConwaySky) July 19, 2023

","url":"https://twitter.com/EdConwaySky/status/1681546110689595392","id":"1681546110689595392","hasMedia":false,"role":"inline","isThirdPartyTracking":false,"source":"Twitter","elementId":"89276328-9764-4653-922c-070246666466"}}”>

Core UK inflation drops to 6.9%

Importantly, underlying inflation has dropped in June too.

Core CPI, which excludes energy, food, alcohol and tobacco, rose by 6.9% in the 12 months to June 2023, down from 7.1% in May (which was a 30-year high).

Economists had expected core inflation would stick at 7.1%, so this could encourage the Bank of England that inflationary pressures are a little less sticky than feared.

But, the Bank’s target is to bring headline CPI inflation down to 2%, so policymakers could still press on with interest rate rises in the month ahead…

🇬🇧 UK June inflation rate lower than expected at 7.9%

Core inflation – a measure which excludes food, energy, alcohol and tobacco prices and which the BoE watches closely to gauge underlying price pressures – also dropped by more than expected, coming in at 6.9% from May's 7.1%,… pic.twitter.com/Oabspav74V

— PiQ (@PriapusIQ) July 19, 2023

","url":"https://twitter.com/PriapusIQ/status/1681547633876189185","id":"1681547633876189185","hasMedia":false,"role":"inline","isThirdPartyTracking":false,"source":"Twitter","elementId":"1dec3359-51bf-465b-9db8-7bc4f68082ce"}}”>

🇬🇧 UK June inflation rate lower than expected at 7.9%

Core inflation – a measure which excludes food, energy, alcohol and tobacco prices and which the BoE watches closely to gauge underlying price pressures – also dropped by more than expected, coming in at 6.9% from May’s 7.1%,… pic.twitter.com/Oabspav74V

— PiQ (@PriapusIQ) July 19, 2023

UK inflation: the key chart

Here’s a chart showing how UK inflation has fallen to its lowest level since March 2022 (when it was 7%) last month, away from the peak of 11.1% hit in October last year.

ONS: Food price inflation eased slightly

Falling prices for motor fuel helped to push the UK inflation rate down in June, the ONS says.

Food prices rose in June 2023 but by less than in June 2022, also leading to an easing in inflation.

Office for National Statistics (ONS) chief economist Grant Fitzner says:

“Inflation slowed substantially to its lowest annual rate since March 2022, driven by price drops for motor fuels. Meanwhile, core inflation also fell back after hitting a 30-year high in May.

“Food price inflation eased slightly this month, although it remains at very high levels.

“Although costs facing manufacturers remain elevated, especially for construction materials and food items, the pace of growth has fallen across the last year, with the overall cost of raw materials falling for the first time since late 2020.”

@GrantFitzner continued: (2/3) 💬 pic.twitter.com/IigwlIP91w

— Office for National Statistics (ONS) (@ONS) July 19, 2023

","url":"https://twitter.com/ONS/status/1681545452951420929","id":"1681545452951420929","hasMedia":false,"role":"inline","isThirdPartyTracking":false,"source":"Twitter","elementId":"5a5104ed-cec6-49a1-a552-783608938bd9"}}”>

This is the first time in several months that UK inflation has come in below expectations, points out Sky New’s Ed Conway.

🚨NEW🚨

UK annual CPI inflation rate DROPS from 8.7% in May to 7.9% in June. Economists had expected 8.2%.

Will be a BIG relief for policymakers. First time it's been below expectations for ages.

Core CPI inflation also falls to 6.9%. Was 7.1% in May.— Ed Conway (@EdConwaySky) July 19, 2023

\n","url":"https://twitter.com/EdConwaySky/status/1681544860568809473","id":"1681544860568809473","hasMedia":false,"role":"inline","isThirdPartyTracking":false,"source":"Twitter","elementId":"57837375-ca5b-4223-86c6-27483b66e6ad"}}”>

🚨NEW🚨

UK annual CPI inflation rate DROPS from 8.7% in May to 7.9% in June. Economists had expected 8.2%.

Will be a BIG relief for policymakers. First time it’s been below expectations for ages.

Core CPI inflation also falls to 6.9%. Was 7.1% in May.— Ed Conway (@EdConwaySky) July 19, 2023

UK inflation falls faster than expected in June

Newsflash: UK inflation has fallen to a 15-month low, but still remains at painfully high levels.

The consumer price index rose by 7.9% in the year to June, new figures from the Office for National Statistics show, down from 8.7% in May.

That’s the lowest reading since March 2022.

Annual inflation slowed in June 2023.

▪️ Consumer Prices Index including owner occupiers’ housing costs (CPIH) rose by 7.3% in the 12 months to June 2023, down from 7.9% in May

▪️ Consumer Prices Index (CPI) rose by 7.9%, down from 8.7% in May➡️ https://t.co/cPUYOHcBiw pic.twitter.com/hDD1Q2AiJb

— Office for National Statistics (ONS) (@ONS) July 19, 2023

","url":"https://twitter.com/ONS/status/1681544403284811776","id":"1681544403284811776","hasMedia":false,"role":"inline","isThirdPartyTracking":false,"source":"Twitter","elementId":"38239546-0c44-4c1f-89b6-4adb320bd11f"}}”>

Annual inflation slowed in June 2023.

▪️ Consumer Prices Index including owner occupiers’ housing costs (CPIH) rose by 7.3% in the 12 months to June 2023, down from 7.9% in May

▪️ Consumer Prices Index (CPI) rose by 7.9%, down from 8.7% in May➡️ https://t.co/cPUYOHcBiw pic.twitter.com/hDD1Q2AiJb

— Office for National Statistics (ONS) (@ONS) July 19, 2023

It’s a larger fall than expected, with City economists having predicted a fall to 8.2%, which will cheer policymakers at the Bank of England.

The British pound is holding just ahead of 1.30 ahead of UK inflation data which is to be released later this morning. #GBPUSD

— SCOFIELD! (@Scofield_Fx) July 19, 2023

\n","url":"https://twitter.com/Scofield_Fx/status/1681543540327821312","id":"1681543540327821312","hasMedia":false,"role":"inline","isThirdPartyTracking":false,"source":"Twitter","elementId":"8017d3a8-f9a9-4afa-9e9b-2c2f21ea6fd3"}}”>

The British pound is holding just ahead of 1.30 ahead of UK inflation data which is to be released later this morning. #GBPUSD

— SCOFIELD! (@Scofield_Fx) July 19, 2023

High inflation has been eating into UK workers’ wages for months, with pay rises failing to keep pace with rising prices

Nela Richardson, chief economist at payroll operator ADP, says rapidly rising prices have had “a downbeat effect” on worker sentiment about their pay.

Richardson explains:

One in 2 UK workers reported that they were underpaid for their job compared to 1 in 4 globally, according to ADP’s global study of more than 32,000 workers in 17 countries.

And while globally workers expected their pay to rise by 8.3% on average in 2023, UK workers expect wages to grow by just 5.6% this year.

RBC Capital Markets’ economists expect UK CPI inflation to have fallen to 8.2% y/y in June from 8.7% in May.

But, a large part of that fall is, however, expected to have come from non-core items, including motor fuel and food, rather than the ‘core inflation’ which the Bank of England watches closely.

This morning’s inflation numbers will be critical to the Bank of England’s next decision on UK interest rates, due in early August.

Michael Saunders, senior adviser at Oxford Economics and a former BOE rate-setter, told Bloomberg that anything above 8.2% “would be deeply alarming” and anything below “would be somewhat reassuring.”

Currently, a half-point increased in interest rates, from 5% to 5.5%, is seen as more likely (a 58% chance, according to the money markets) than a smaller, quarter-point rise to 5.25% (a 42% chance).

Markets are pricing in that Bank rate will peak at 6.0% at the end of the year, lower than the 6.5% peak in early 2024 they had recently forecast.

An index of London-listed homebuilders rose as much as 4% having fallen 12.15% in the 2nd 1/4 on top of a 44.4% slump in 2022. Traders now see BoE interest rates peaking at around 6.00% in Dec & not the 6.5% predicted earlier this mth. All👀 on CPI in morn https://t.co/u0dsHf3vxR

— Emma Fildes (@emmafildes) July 18, 2023

\n","url":"https://twitter.com/emmafildes/status/1681332912891863040","id":"1681332912891863040","hasMedia":false,"role":"inline","isThirdPartyTracking":false,"source":"Twitter","elementId":"bcba46ef-ba25-4e3b-b0bd-e5e5002e2042"}}”>

An index of London-listed homebuilders rose as much as 4% having fallen 12.15% in the 2nd 1/4 on top of a 44.4% slump in 2022. Traders now see BoE interest rates peaking at around 6.00% in Dec & not the 6.5% predicted earlier this mth. All👀 on CPI in morn https://t.co/u0dsHf3vxR

— Emma Fildes (@emmafildes) July 18, 2023

Introduction: All eyes on June’s UK inflation report

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

Tension is high in the City, and in Westminster, this morning as we await the latest UK inflation report, due at 7am.

June’s CPI report is expected to show that price rises slowed last month. Economists predict that the annual inflation forecast will dip to 8.2% from 8.7% in both April and May.

That would be the lowest reading in 15 months, since March 2022.

City economists predict that food and fuel provide the drag on inflation last month, as we catch up with the sharp price rises in summer 2022.

Yesterday, data from Kantar showed that grocery price growth cooled to 14.9% per year in over the four weeks to 9 July.

But while a fall in inflation would be welcome, prices have been rising much faster than the Bank of England’s 2% inflation target for around two years.

Traders will also be watching for the latest core inflation reading, which is expected to remain at a 31-year high of 7.1%. That would maintain the pressure on the Bank of England to keep raising interest rates this year.

British households and businesses are bracing for UK inflation figures on Wednesday that are expected to keep the pressure on the Bank of England to raise interest rates again https://t.co/176c5GYp2u pic.twitter.com/jRk6MwcJHN

— Bloomberg UK (@BloombergUK) July 18, 2023

","url":"https://twitter.com/BloombergUK/status/1681282007697969152","id":"1681282007697969152","hasMedia":false,"role":"inline","isThirdPartyTracking":false,"source":"Twitter","elementId":"7114fd8b-8827-4779-b0ae-aee7354ce89d"}}”>

On Monday, prime minister Rishi Sunak acknowledged that inflation is not coming down as quickly as he would like (as his target to halve it by the end of the year, to around 5%, looks more challenging).

Sunak told LBC:

“Inflation is prices going up, and they are all going up faster than we would like.

“That’s what is eating into people’s pay packets, it’s what’s eroding their savings, it’s what’s putting up interest rates and putting pressure on mortgages.

“So, the best way to help people with the cost of living … is to bring down inflation.

We’re about to find out how much progress has been made….

Also coming up today

Jaguar Land Rover-owner Tata is expected to announce it will build its flagship electric car battery factory in the UK, in a major boost for the British car industry.

The new plant in Somerset is likely to be officially announced on Wednesday, backed with £500m in government funding,

The agenda

-

7am BST: UK inflation report for June

-

9.30am BST: UK house price index for May

-

10am BST: Final estimate of eurozone inflation in June

-

1.30pm BST: US building permits for June

-

2.15pm BST: Treasury Committee to question Financial Conduct Authority on topics including mortgages and savings

-

4pm BST: Business and Trade committee hearing on the road fuel market with the CMA and Mohsin Issa CBE, co-owner of Asda.

Read More: World News | Entertainment News | Celeb News

Guardian